News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1SUI Price Remains Optimistic As 7-Week-Long Death Cross Nears End2TRUMP Meme Coin Falls 16% As Short Sellers Remain Highly Active3Can Cardano (ADA) Bounce to Continue Its Rebound? This Pattern Says Yes!

Is SUI’s Current Downtrend a Golden Opportunity to Accumulate? This Fractal Says Yes!

CoinsProbe·2025/04/07 15:15

Avalanche (AVAX) Mirrors a Past Bullish Setup – Is This Final Dip Before the Liftoff?

CoinsProbe·2025/04/07 15:15

SPX6900 (SPX) in Green Despite Market Turbulence – Is a Strong Rebound Coming?

CoinsProbe·2025/04/07 15:15

SEC to Reevaluate Howey Test Application to Cryptocurrencies

Coinspaidmedia·2025/04/07 15:11

Crypto Market Cap Drops Over 10% in 24 Hours

Coinspaidmedia·2025/04/07 15:11

PayPal Adds SOL and LINK to Supported Cryptocurrencies List

Coinspaidmedia·2025/04/07 15:11

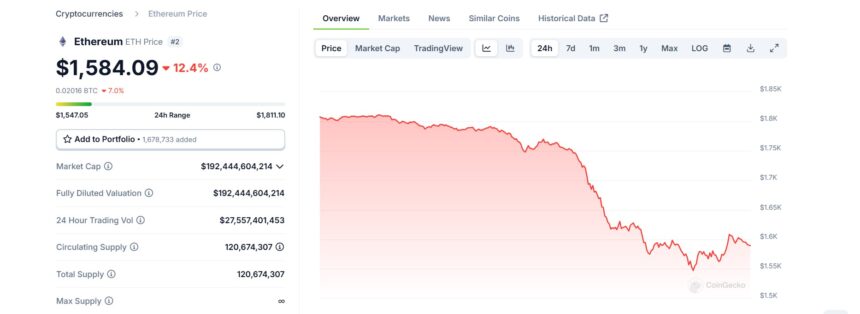

Ethereum whale loses over $100 million as price tumbles double digits

Cryptobriefing·2025/04/07 14:55

Market Turmoil: Investors Scrutinize Key Support Levels in Cryptocurrency

In Brief Price fluctuations increase concerns among cryptocurrency traders. Technical indicators show significant pressure on XRP, ADA, and DOGE. Global economic uncertainties further complicate the cryptocurrency market situation.

Cointurk·2025/04/07 14:22

Investors Face Challenges as Pi Network Struggles to Maintain Value

In Brief Pi coin faces significant pressure from recent market sell-offs. Major investors' exit contributes to a dramatic decline in trading volume. Experts warn of a potential drop in Pi coin's value to $0.30.

Cointurk·2025/04/07 14:22

Bitcoin, Ethereum, Solana plunge on Monday as Trump Tariff War goes on

Cryptotimes·2025/04/07 13:00

Flash

- 10:58Market News: VanEck Files S-1 Form for BNB ETFPANews May 5th news, according to market sources: VanEck has submitted the S-1 form for a BNB ETF to the U.S. Securities and Exchange Commission.

- 10:58CryptoQuant: ETH Accumulation Addresses Continue to Increase Holdings Despite Unrealized Losses, Growing Over 22% in Two MonthsAccording to a CryptoQuant analyst, since Ethereum reached a cycle high of $4,107 on December 16, 2024, its price has experienced a continuous pullback. However, during this bear market phase, ETH accumulation addresses are still increasing their holdings. ETH accumulation addresses refer to those that continuously receive ETH without significant selling, and their balance remains stable or increases over time. Whether they belong to large or small holders, these addresses are typically long-term holders who have held Ethereum for more than 155 days. On-chain data shows that on March 10, these accumulation addresses entered an unrealized loss zone when Ethereum fell to $1,866.7, while their average holding price remained at $2,026. Nevertheless, despite the unrealized losses, ETH accumulation addresses continue to increase their ETH holdings: from 15.5356 million ETH on March 10 to 19.0378 million ETH by May 3, an increase of 22.54%. This demonstrates that, in the long term, ETH investors exhibit strong confidence in Ethereum's assets, projects, and ecosystem.

- 10:56Analysis: ETH/BTC Volatility Indicator Tightens as Market Focuses on Ethereum's Pectra Upgrade MovementPANews reported on May 5, according to CoinDesk, that the Bollinger Bands indicator for the ETH/BTC exchange rate has narrowed to its tightest level since June 2020, indicating that market volatility may be about to increase. Typically, a contraction in the Bollinger Bands signals an imminent price breakout, potentially leading to significant fluctuations. This technical signal appears on the eve of Ethereum's Pectra upgrade scheduled for May 7. The upgrade aims to enhance network scalability and validator operational efficiency, including raising the maximum staking limit for a single validator from 32 ETH to 2048 ETH and increasing the number of "blob" data units per block from 3 to a maximum of 9. Additionally, Pectra will introduce the EVM Object Format (EOF) to optimize smart contract structures. Analytics firm Nansen pointed out that the Pectra upgrade will benefit Layer 2 networks the most, further solidifying Ethereum's position as a data availability layer by expanding blob capacity, reinforcing its Rollup-centric scaling strategy. Sectors such as DeFi, NFT, and blockchain gaming may also benefit from this.