Analysis: ETH/BTC Volatility Indicator Tightens as Market Focuses on Ethereum's Pectra Upgrade Movement

PANews reported on May 5, according to CoinDesk, that the Bollinger Bands indicator for the ETH/BTC exchange rate has narrowed to its tightest level since June 2020, indicating that market volatility may be about to increase. Typically, a contraction in the Bollinger Bands signals an imminent price breakout, potentially leading to significant fluctuations. This technical signal appears on the eve of Ethereum's Pectra upgrade scheduled for May 7. The upgrade aims to enhance network scalability and validator operational efficiency, including raising the maximum staking limit for a single validator from 32 ETH to 2048 ETH and increasing the number of "blob" data units per block from 3 to a maximum of 9. Additionally, Pectra will introduce the EVM Object Format (EOF) to optimize smart contract structures.

Analytics firm Nansen pointed out that the Pectra upgrade will benefit Layer 2 networks the most, further solidifying Ethereum's position as a data availability layer by expanding blob capacity, reinforcing its Rollup-centric scaling strategy. Sectors such as DeFi, NFT, and blockchain gaming may also benefit from this.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Dev Corp. acquires a Solana validator node for $3.5 million

NYDIG: The "Dry Powder" of Bitcoin-Holding Companies May Significantly Drive Up Prices

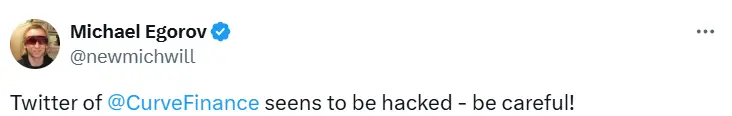

Curve's Official X Account Hacked, Do Not Click Any Links