News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

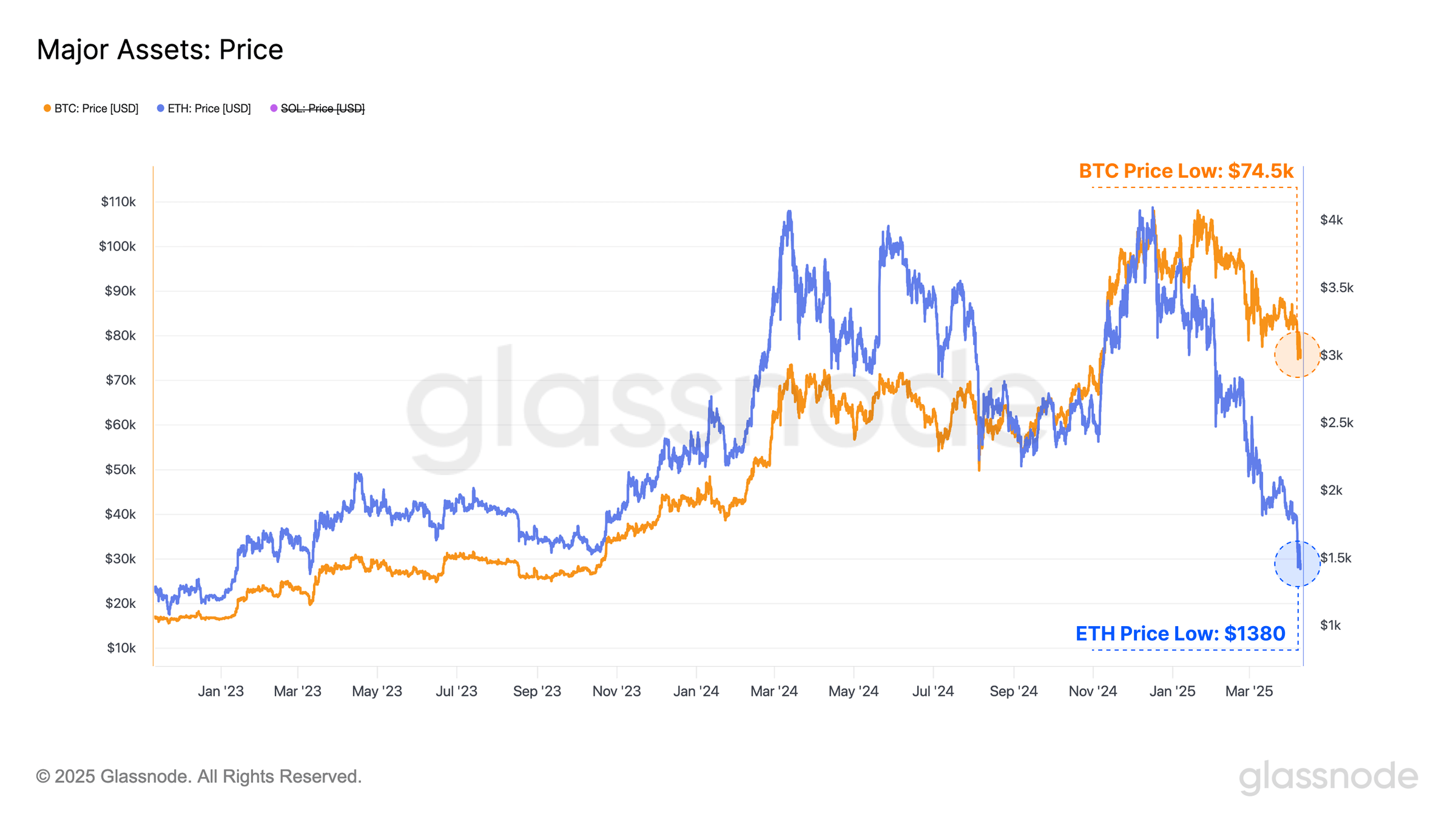

An analyst compares Ethereum to Nokia, suggesting it may lose relevance as Solana outperforms in scalability and user experience. While Ethereum maintains dominance in DEX volume, it must accelerate its development to avoid being overtaken.

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

Over $2.5 billion in Bitcoin and Ethereum options expire today, with analysts anticipating market volatility due to fading call premiums and global uncertainty. Traders are eyeing these expirations for clues on short-term price direction.

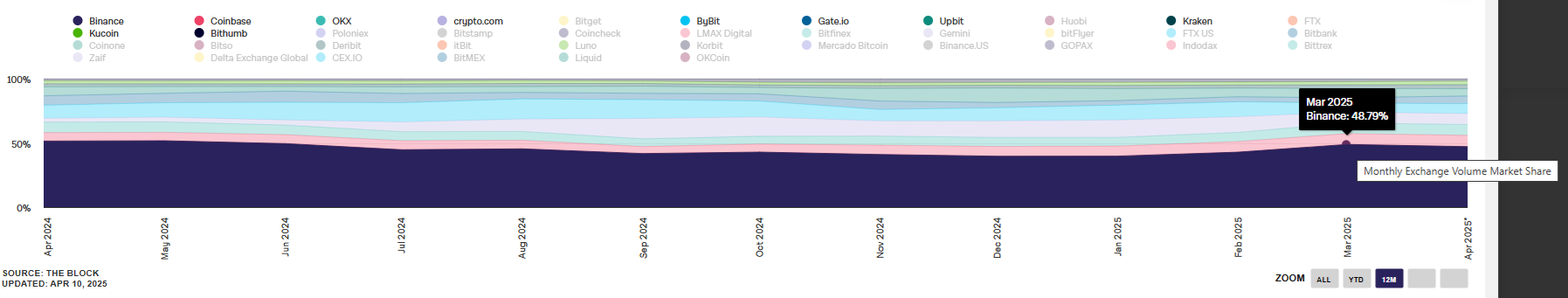

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.

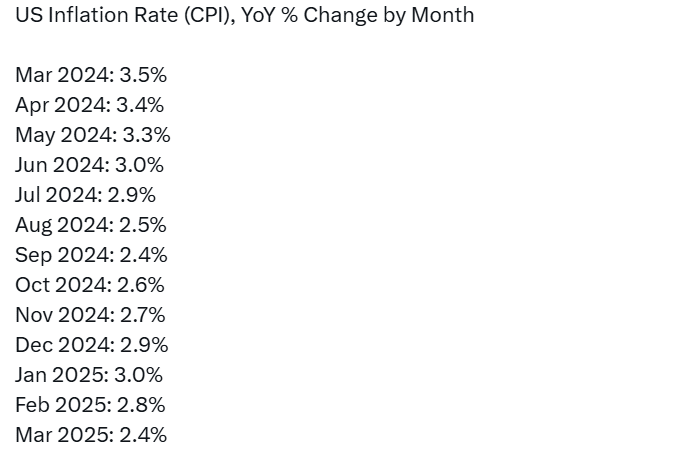

- 20:47Macquarie: The Dollar Is Unlikely to Fully Reverse Its Recent DeclineAccording to a report by Jinse Finance, Macquarie strategist Thierry Wizman stated that even if the Trump administration removes all tariffs, the dollar is unlikely to fully reverse its recent declines. He said, "After all, aside from capital flight, considering the decline in the integrity of some U.S. institutions and systems, it is also necessary to reduce reliance on the dollar. The dollar will no longer be an indispensable currency, but more of an alternative to a few comparable currencies like the euro."

- 20:46Data: Three Whale Addresses Spent $7.2 Million to Buy 5,362 ETH in the Last 2 HoursAccording to Lookonchain monitoring, in the past two hours, three whale addresses spent a total of $7.2 million to purchase 5,362 ETH. Address 0xDdb4 borrowed 3.44 million USDC from Aave and then used these 3.44 million USDC to purchase 1,856 ETH. Address 0xf84d borrowed 1.64 million USDC from Aave and then spent 2.34 million USDC to purchase 1,259 ETH. A newly created wallet (0x69D0) withdrew 2,250 ETH (worth $4.12 million) from a CEX.

- 20:46Analyst: U.S. Stock Market Has Yet to Reflect Damage from TariffsTrade Nation analyst David Morrison stated in a report that the recent rebound in the U.S. stock market still fails to reflect the "severe damage tariffs have already caused to global trade." The U.S. stock market has rebounded from the decline following the announcement of global tariffs by the U.S. in early April, buoyed by expectations of interest rate cuts and stronger-than-expected earnings reports from Meta and Microsoft. Traders are currently focused on the expectation that President Trump will "reach some sort of settlement on the tariff issue," while the Federal Reserve will "cut interest rates when signs of economic distress appear."