News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1BlackRock’s $1 Billion Bitcoin Investment Boosts Market Outlook2Week 16 On-Chain Data: Intensifying Structural Supply-Demand Imbalance, Data Reveals Solid Blueprint for Next Bull Run?3Bloomberg Increases Approval Odds for Solana ETF to 90%, Highlights XRP and DOGE as Potential Contenders

PEPE Mirrors Its Past Bottom – Will RSI Divergence Spark Another Rebound Rally?

CoinsProbe·2025/04/11 07:44

Is Kaspa (KAS) Gearing Up for a Bullish Reversal? This Fractal Says Yes!

CoinsProbe·2025/04/11 07:44

RENDER’s Recovery Kicks Off With a Classic Pattern – Will TAO Follow the Same Path?

CoinsProbe·2025/04/11 07:44

Research Report | In-Depth Overview of Mind Network & FHE Market Valuation

Bitget·2025/04/11 06:52

Helium cleared by SEC as HNT market cap hits $480 million

Grafa·2025/04/11 02:40

Florida Bitcoin Reserve bill moves forward with unanimous vote

Grafa·2025/04/11 02:40

MicroStrategy holds 528K BTC at risk as debt pressure builds

Grafa·2025/04/11 02:40

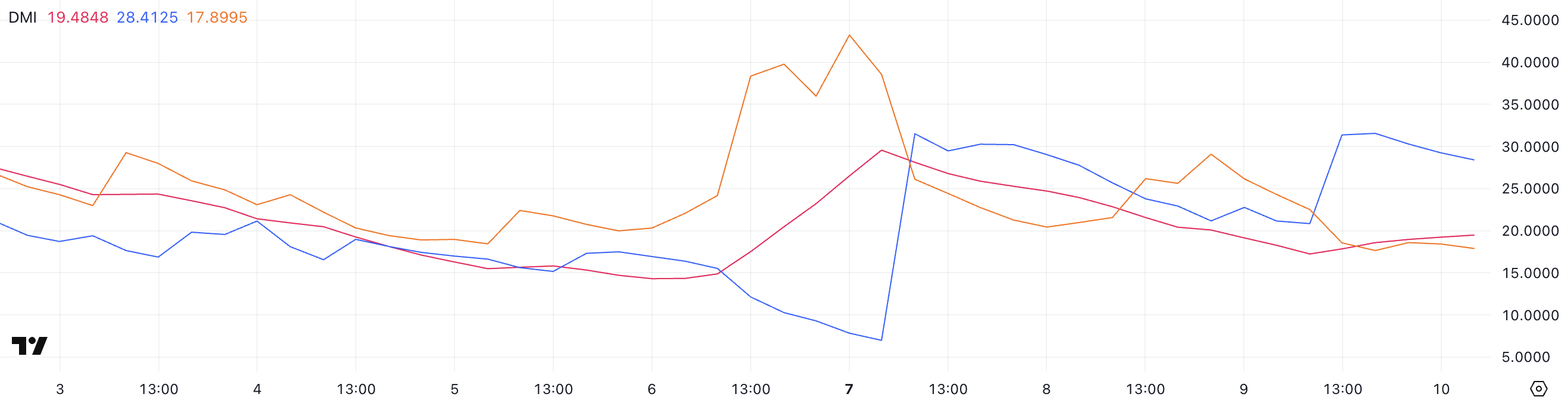

Bitcoin’s Recent Surge Suggests Potential Consolidation Amid Weakening Trend Indicators

Coinotag·2025/04/11 02:00

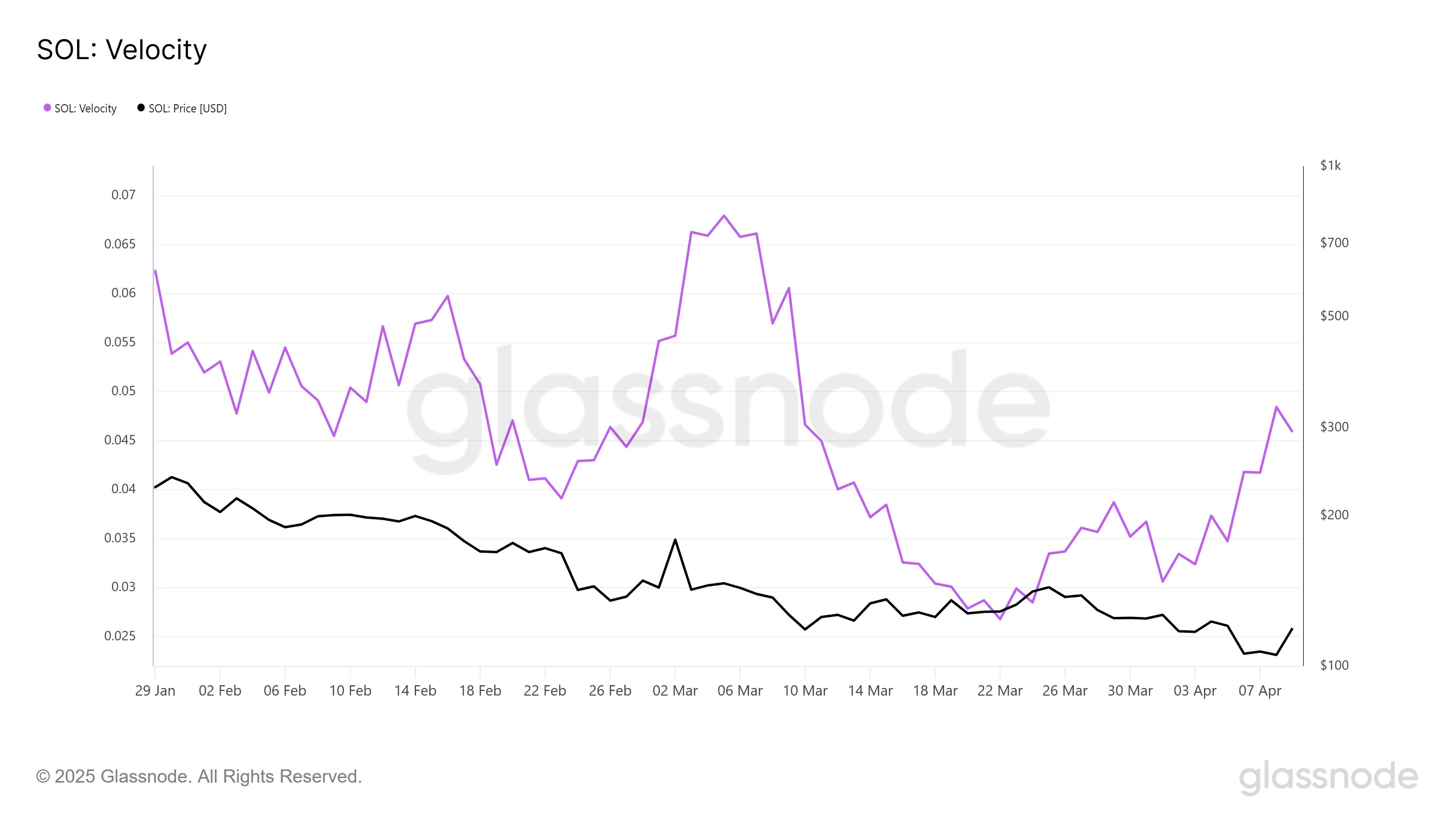

Solana Price Nears $120: Bullish Recovery Possible If Resistance Levels Are Broken

Coinotag·2025/04/11 02:00

Bitcoin flat as China announces new 125% tariff on US goods, gold spikes, oil declines

CryptoSlate·2025/04/11 00:48

Flash

- 14:55Bitwise Executive: Bitcoin Could Reach $1 Million by 2029 Driven by ETF and Government DemandPANews reported on May 1, according to Cointelegraph, that André Dragosch, Head of Research at Bitwise Europe, predicts Bitcoin could reach $1 million by 2029, surpassing gold's current market value of $21.7 trillion. His analysis indicates that Bitcoin's base target price for the 2025 cycle is $200,000, and if the U.S. government adopts a "budget-neutral" strategy to directly allocate Bitcoin, it could rise to $500,000. The first-year performance of the U.S. spot Bitcoin ETF exceeded expectations, with BlackRock's IBIT ETF setting a record for the fastest growth in history. Dragosch believes that as major investment banks like Merrill Lynch and Morgan Stanley gradually open their channels, "structural capital inflows" will extend the Bitcoin cycle.

- 14:37Tether Releases Q1 Report: U.S. Treasury Holdings Near $120 Billion, Traditional Investment Operating Profit Exceeds $1 BillionPANews reported on May 1 that Tether released an attestation report for the first quarter of 2025, issued by BDO, confirming the accuracy of its financial data and Financial Reserves Report (FFRR), and disclosed its asset status as of March 31. The report shows that Tether's total exposure to U.S. Treasury bonds is nearly $120 billion (including indirect holdings), reaching a record high. This quarter, traditional investment operating profit exceeded $1 billion, mainly benefiting from the performance of the U.S. Treasury bond portfolio, with gold earnings partially offsetting cryptocurrency market volatility. Excess reserves reached $5.6 billion, reflecting its liquidity management capability. In terms of operations, the circulating supply of USDT increased by approximately $7 billion, and the number of user wallets increased by 46 million, a quarter-on-quarter growth of 13%. Additionally, Tether invested over $2 billion through Tether Investments in fields such as renewable energy and artificial intelligence, with management emphasizing that such investments are not included in stablecoin reserves but aim to promote a sustainable digital economy. As of March 31, Tether's total assets were approximately $149.275 billion, with total liabilities of about $143.683 billion, and asset size exceeding total liabilities.

- 14:37Bitcoin ETF sees a net outflow of 382 BTC today, Ethereum ETF sees a net outflow of 1648 ETHPANews May 1st news, according to Lookonchain monitoring, today 10 Bitcoin ETFs saw a net outflow of 382 BTC, approximately $36.68 million. Among them, Fidelity had a single-day outflow of 1,462 BTC (approximately $140 million), with a current holding of 198,376 BTC, valued at approximately $19.07 billion. At the same time, 9 Ethereum ETFs experienced a net outflow of 1,648 ETH, approximately $3.03 million. Among them, Grayscale's ETHE had a single-day outflow of 3,987 ETH (approximately $7.32 million), with a current total holding of 1,144,481 ETH, with a market value of approximately $21 billion.