Solana’s $4,500 Dream Faces Harsh Reality: 3 Reasons the Rally May Stall Below $300

- Trading volumes together with investor engagement have decreased on the Solana blockchain as meme coin speculation has diminished.

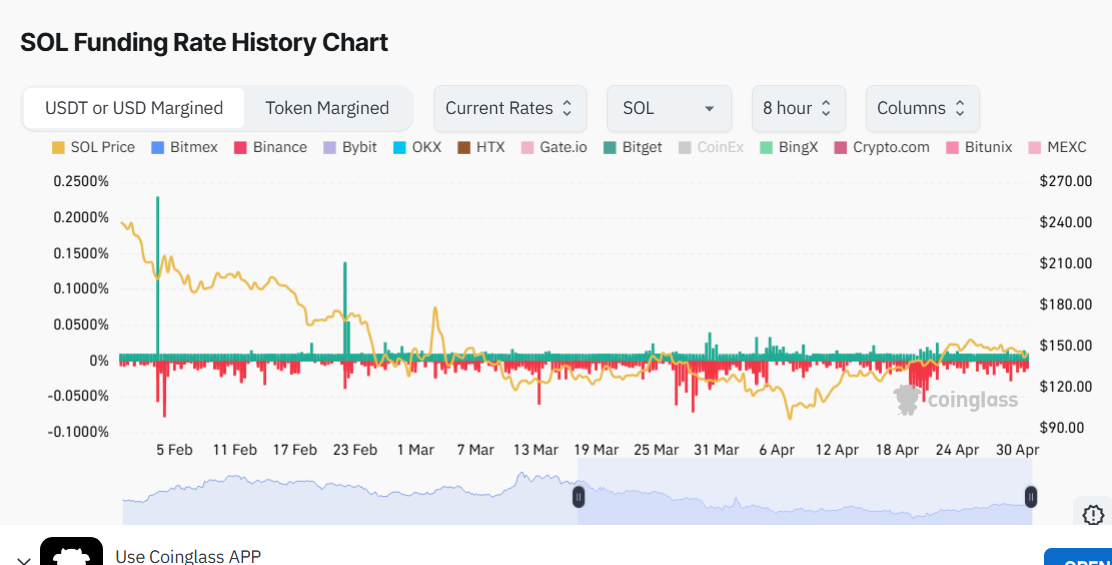

- The funding rate data from Coinglass shows traders buying and selling Solana futures contracts have no predictions of a major price rise for the near future.

- The price of Solana faces limitations due to technical obstacles and fading market support which will prevent it from reaching $300.

In recent weeks, Solana (SOL) has been spotlighted for its exceptional blockchain speed and low fees, which supported a wave of meme coin launches. Several signs indicate that the frenzy surrounding meme coins built on Solana started losing its momentum despite initial predictions of high-throughput utility. The trading activity of various high-profile meme tokens developed on Solana has decreased substantially.

The blockchain’s most innovative trend has lost its profitable appeal because liquidity decreased and investor interest declined. Changing market attitudes show through these declining trends, although this decline does not imply final innovation death within Solana’s system.

CoinGlass Funding Rate Reveals Traders Expect a Sideways Market

According to the latest data from Coinglass, funding rates across Solana futures markets suggest that most traders are not positioning for a major rally. The funding rate remains steady at a basic level as it provides insights about market sentiment which neither backs bullish nor bearish sentiments.

Source: Coinglass

Source: Coinglass

The recent data reveals traders have lost their enthusiasm for holding amplified long positions despite the funding costs which previously soared during price forecasts. The absence of trader enthusiasm indicates market participants expect a price hold or market decrease which could prevent Solana from achieving $4,500.

Technical and Market Structure Limit Breakout Potential

Technical barriers at the $300 threshold have shown themselves to be impervious to Solana’s superior processing capacity and its large developer base. The price continues to fail at maintaining upward movement through important resistance areas.

Source: (X)

Source: (X)

The price has failed to move above $300 because analysts believe spot market demand is low as well as hype for new Solana-based assets is fading. The movement of liquidity toward new ecosystems along with stable digital assets, might make it difficult for Solana to hold onto its capital inflows. Analytics suggest that the present market conditions will prevent persistent growth towards the $4,500 target price.

Long-Term Vision Still in Play, But Short-Term Constraints Mount

Solana prepares for multiple exceptional system updates and ecosystem expansion in its extended strategy, but plans to adopt slower developments in the upcoming months. Between investor actions and derivatives market sentiment indications both show modest positive expectations. Professional analysts indicate that the market needs genuine price appreciation and sustainable business growth as prerequisites for initiating a substantial price rally. The present market situation does not support the vision of Solana reaching $4,500.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump says US economy faces transition with 60% recession risk

Bitcoin Reaches $97K Amidst Sluggish Network Activity: Time for Investor Alarm?

Unpacking the Paradox: Skyrocketing Bitcoin Values Amidst Noticeable Downturn in Network Activity

XRP price risks 45% decline to $1.20 — Here is why

Ethereum Analyst Foresees 2025 Breakout Despite Market Trends