Bitcoin Price Steadies at $96,362 as Market Sentiment Shifts to Greed: What’s Next?

Bitcoin Price Steadies as Market Sentiment Shifts to Greed: What's Next?

Bitcoin Price Steadies as Market Sentiment Shifts to Greed: What's Next?

Bitcoin (BTC) is hovering around $96,362, holding firm as the crypto market transitions from fear to greed. The latest CMC Fear and Greed Index rose to 56—up sharply from 24 just a month ago—highlighting a growing appetite for risk among investors.

Over the past 24 hours, BTC has dipped slightly (-0.44%), yet the broader trend remains intact. Bitcoin commands a market cap of $1.91 trillion, backed by 19.85 million coins in circulation, and momentum is being fueled by both technical stability and an improving sentiment backdrop.

- Fear and Greed Index: 56 (Neutral-Greed)

- Monthly low: 24 (Fear)

- Yearly high: 88 (Extreme Greed)

- Market Cap: $1.91T

- 24H Trading Volume: $23.8B

This rise in sentiment comes amid real-world progress and institutional signals that could extend Bitcoin’s bullish setup through Q2.

Adoption and Regulation Reshape the Narrative

Two major developments are reinforcing confidence in crypto as a legitimate asset class. First, in a push to modernize commerce, 90% of stores in Cannes, France, are expected to accept crypto payments by summer 2025.

According to Lunu Pay, training workshops are already underway as merchants prepare to embrace Web3 payments. Cannes joins a growing list of cities—including Lugano and Panama City—where crypto is going mainstream.

Second, a regulatory crackdown is taking shape. U.S. authorities are investigating Cambodia-based Huione Group, allegedly linked to $98 billion in illicit crypto activity since 2014. FinCEN now labels Huione a “primary money laundering concern,” a move praised by compliance experts as a turning point in crypto law enforcement.

Meanwhile, the SEC, under pressure after legal losses, may adopt a more collaborative stance toward crypto regulation—potentially modeling its playbook on the IRS’s advisory-first approach .

These trends suggest a shift from crypto’s “Wild West” past toward a more structured, institutional-friendly framework.

Bitcoin Technical Levels to Watch

Bitcoin’s recent price action is consolidating above a key ascending trendline that began forming in late April. The 50-period EMA ($95,833) and the 0.382 Fibonacci level ($96,048) are providing near-term support.

A bounce from this region could propel BTC toward $96,782, then $97,329, with the potential to revisit the recent high of $97,966.

Trade Setup:

- Entry: $96,000–95,800 (on bounce confirmation)

- Target: $97,330 → $97,960

- Stop Loss: Below $95,450

However, traders should remain cautious as the MACD indicates waning momentum. A clean breakout or confirmation via a bullish MACD crossover is necessary before entering new long positions.

Conclusion

With sentiment improving, real-world use cases expanding, and regulatory clarity emerging, Bitcoin’s current consolidation could mark the base for its next leg higher.

While volatility remains, the $96K level continues to attract demand—suggesting the path of least resistance may still be up.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Janover Initiates Solana-Focused Treasury Strategy Post Rebrand

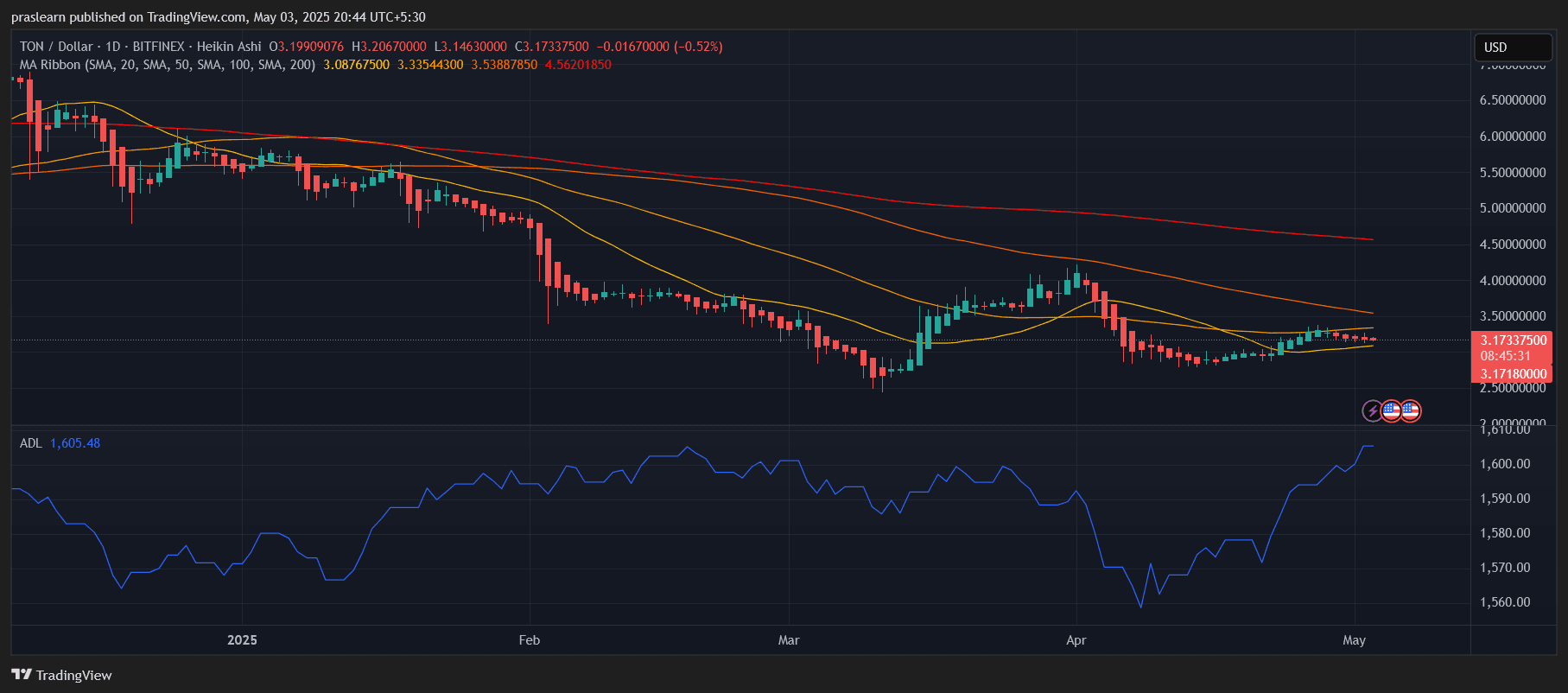

TON Price Prediction: Can Toncoin Hit $4 in May?

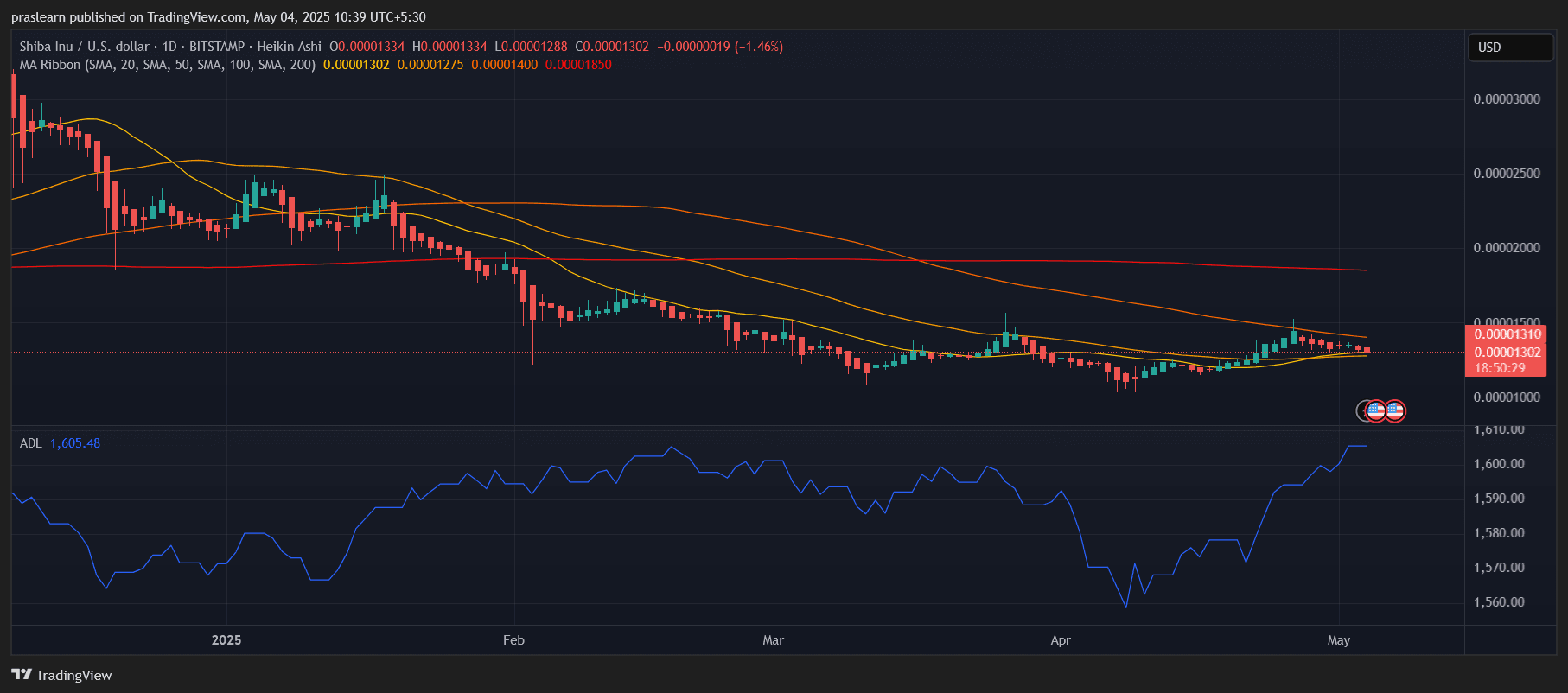

Will Shiba Inu Price Reach $1 in May?

New Litecoin Price Prediction Targets $100 and Beyond – Where Is LTC Headed Next?