Ethereum price prediction 2025–2030: ETH could reach $5,925 if upgrades succeed

- Ethereum is the world’s second-largest cryptocurrency.

- Ethereum’s next major upgrade, Pectra, will go live on 7 May.

- Vitalik Buterin has proposed replacing the Ethereum Virtual Machine (EVM) bytecode with RISC-V.

Ethereum is back in the spotlight as traders prepare for what could be a decisive breakout year.

With the Pectra upgrade scheduled for 7 May, combining two long-planned enhancements—Prague and Electra—the Ethereum blockchain is undergoing major changes.

At the same time, increased staking activity, improved scalability via Layer-2 solutions, and proposals to overhaul Ethereum’s virtual machine are shaping long-term expectations.

These upgrades, combined with falling gas fees and rising developer activity, are fuelling renewed forecasts that put ETH’s 2025 high at nearly $6,000.

Ethereum’s position as the world’s second-largest cryptocurrency by market capitalisation continues to attract institutional attention, even amid volatility.

Its ability to support decentralised applications and token ecosystems makes it critical to crypto’s future.

As activity migrates to cheaper sidechains, the base layer is evolving with efficiency in mind.

Early signals show ETH building momentum

Ethereum has started showing early signs of recovery after months of price stagnation.

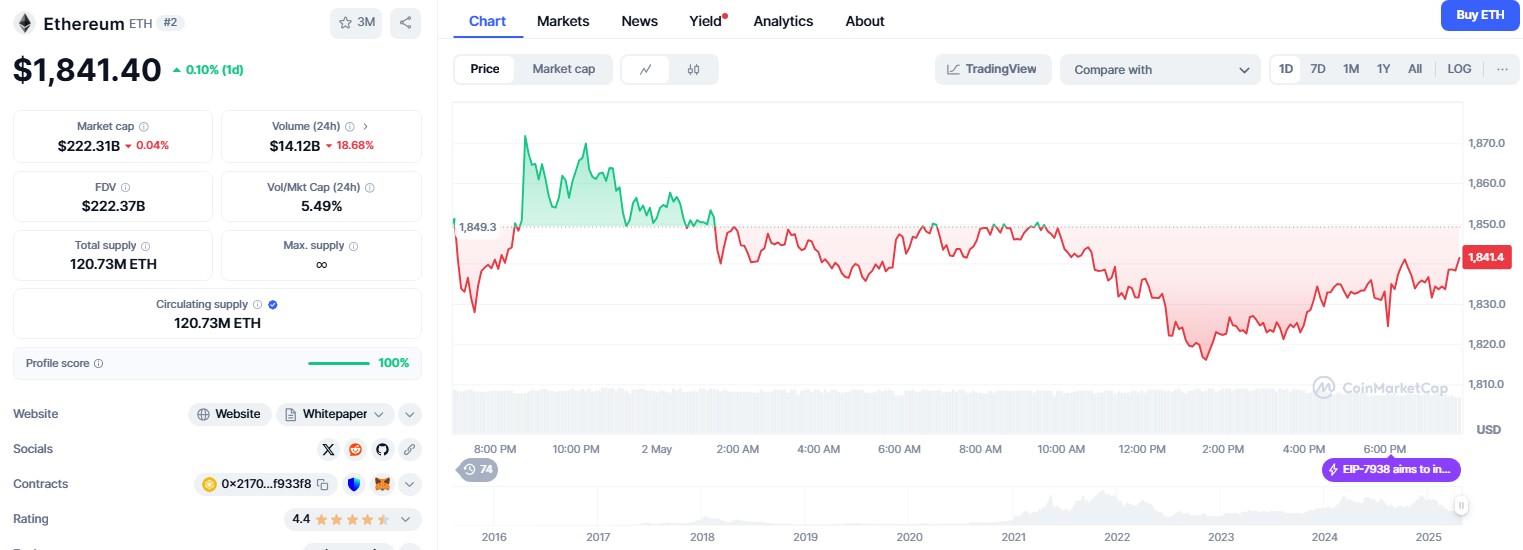

ETH is currently trading at $1,841, above the 9-day simple moving average, with the relative strength index at 58.3 , suggesting building momentum.

Source: CoinMarketCap

Analysts note that the price is consolidating in a range between $1,600 and $1,900, forming a potential rounding bottom pattern.

If ETH breaks through $1,900, the next resistance could appear near $2,200.

Although gas fee revenues fell to 3.18 ETH in April and average gas prices hit a four-year low at $0.16, the drop in network costs is making Ethereum more accessible for users.

The sharp fall in base-layer activity has raised sustainability concerns, but also indicates the shift of transactions to Layer-2s like Arbitrum and Base.

Pectra and staking add long-term value

Ethereum’s next major upgrade, Pectra, will go live on 7 May and is expected to introduce a range of technical improvements.

By combining the Prague and Electra upgrades, Pectra aims to streamline validator operations and reduce latency.

Alongside this, co-founder Vitalik Buterin has proposed replacing the Ethereum Virtual Machine (EVM) bytecode with RISC-V, a widely used open-source instruction set architecture.

If implemented, this would help Ethereum align more closely with traditional computing infrastructure and enhance future compatibility.

ETH staking has also increased, with the Ethereum 2.0 network drawing growing interest from long-term holders.

Combined with Layer-2 scaling solutions and low transaction costs, these developments are strengthening Ethereum’s fundamentals as a decentralised application platform.

ETH forecast shows a broad range

Ethereum’s price outlook for 2025–2030 varies significantly depending on market sentiment, adoption rates, and global macroeconomic factors.

In the near term, ETH could test resistance at $2,400 by the end of 2025 if the broader crypto market trends positively.

However, upside is expected to be capped near $2,500 unless momentum builds.

CoinPedia forecasts suggest that ETH could reach a new high of $5,925 in 2025, assuming favourable conditions.

Their predicted price range for 2025 lies between $2,917 and $5,925, with an average around $4,392.

By 2026, the upper range increases to $6,610, and by 2030, projections go as high as $15,575.

Across longer timeframes, the estimates show further growth.

For 2040, ETH could hit $123,678, and in 2050, a potential peak of $255,282 is suggested.

However, each yearly estimate also includes lower and mid-range possibilities, showing that investor caution remains.

Other firms have varied forecasts: Changelly expects $4,012.41 in 2025 and up to $24,196 in 2030; Coincodex sees a 2025 high of $6,540.51; and Binance projects a more conservative $3,499.54.

These predictions underscore how Ethereum’s value is tied to both its network upgrades and broader market adoption.

Its future trajectory will depend on continued technical innovation, staking incentives, and decentralised finance use cases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arweave (AR) Breaks $7.85, Eyes 100% Surge Toward $15 Target

BTC Market Share Rises 88% from 2022 Low, Eyes Critical Compression Level

XRP Breaks at $2.20: Here’s What Traders Must Watch for a Breakout

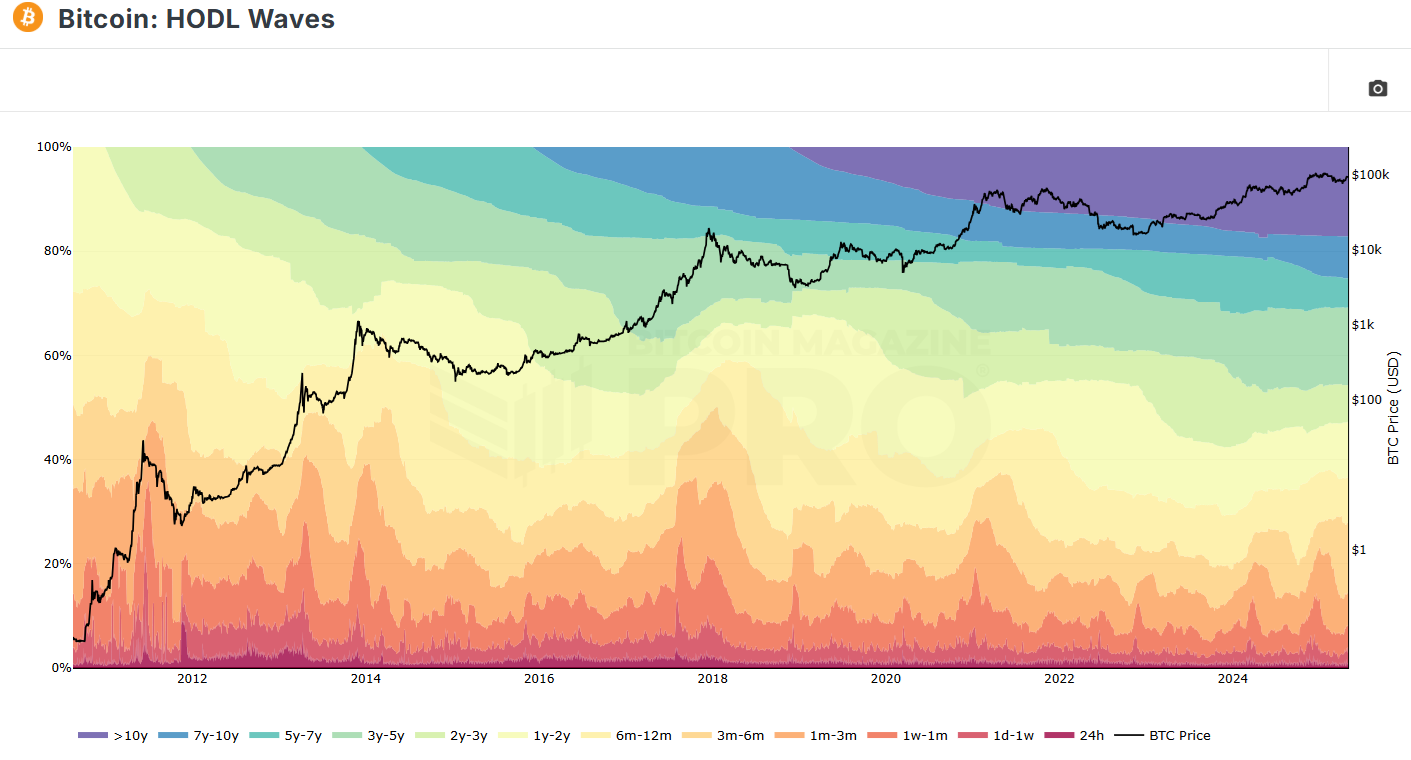

Long-term BTC holders are back in accumulation mode

Share link:In this post: The period of capitulation and spot selling has ended, and almost all wallet cohorts either hold or accumulate. 87.6% of the BTC supply is in profit, as the coin consolidates around $97,000. Short term buyers are in the money, feeling less pressure for wallets aged less than one month.