Opinion: The Market May Misprice the Timing of the Fed's Rate Cuts

PANews reported on May 2, citing Jinshi, that U.S. interest rate strategist Ira Jersey stated the Federal Reserve will wait until the job market stumbles and concerns over tariff-related inflation subside before cutting rates. However, once rate cuts begin, they will be aggressive. The market may have mispriced the timing of the rate cuts, but the pricing of the rate cut magnitude might be accurate. We believe the Federal Reserve might cut rates to 3%, but this will start at the end of this year and proceed rapidly. Previously, "Fed Whisperer" Nick Timiraos indicated that the April employment report makes a June rate cut less likely (although June is still far off), as only one more employment report will be released before then. For now, this means the Federal Reserve does not need to make any statements about the June meeting next week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Raydium to Distribute 500,000 RAY Rewards to LaunchLab and LetsBONK Traders

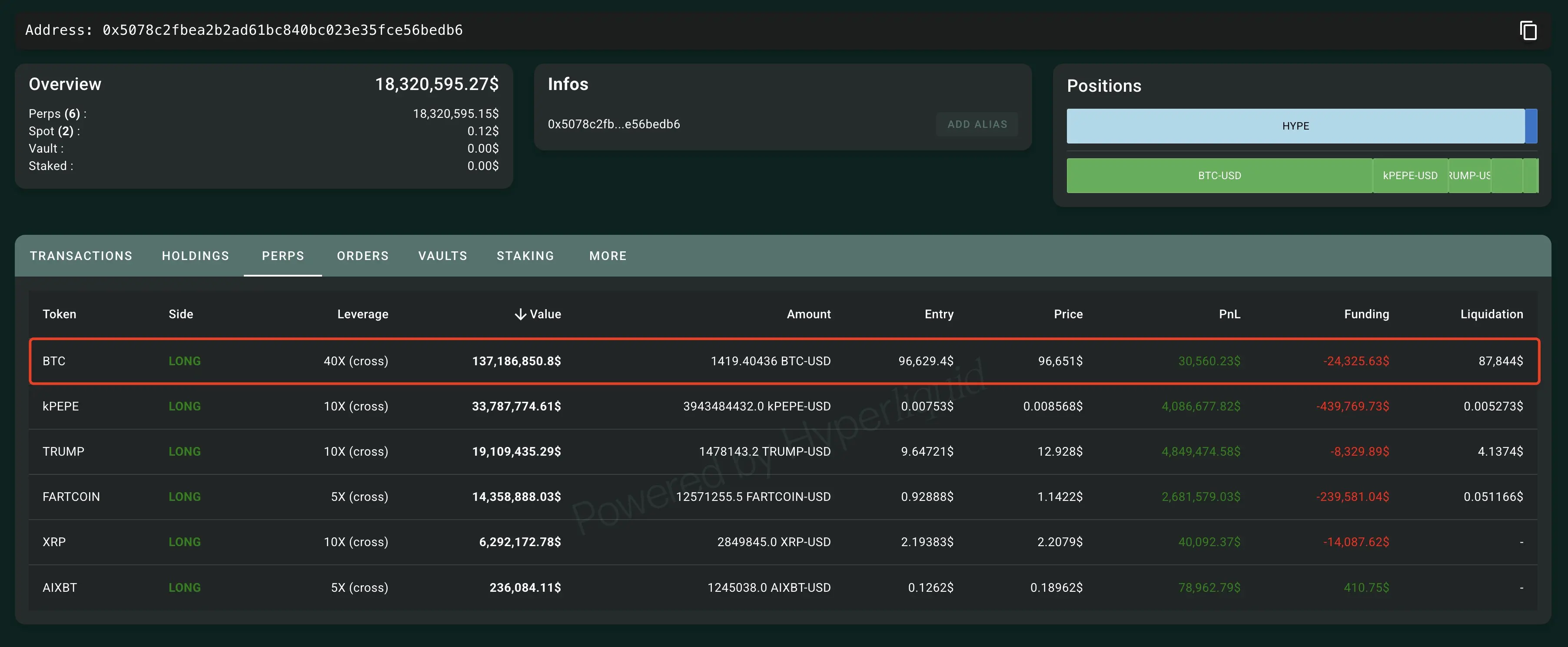

Data: A certain whale goes long on 1,419 BTC on Hyperliquid, with a position value of $137 million

Publicly Listed Company Thumzup Plans to Raise Up to $200 Million, Including for BTC Purchases

Data: A new address withdraws over 66,100 SOL from CEX and stakes it