Stellar (XLM) Faces Critical Support Level as Trader Interest Declines and Death Cross Signals Possible Downtrend

-

Stellar (XLM) has shown frailty in the crypto market as it registers only 2.8% monthly gains, indicating weak trader conviction.

-

XLM’s trading volume has dropped significantly from early 2025 peaks, suggesting diminishing market interest.

-

As XLM approaches the critical $0.26 support, bearish indications point towards potential declines toward $0.239 and $0.20.

Stellar struggles to gain traction amid declining trading volume and trader confidence, with critical support levels at risk of being breached.

Stellar’s Underperformance and Market Dynamics

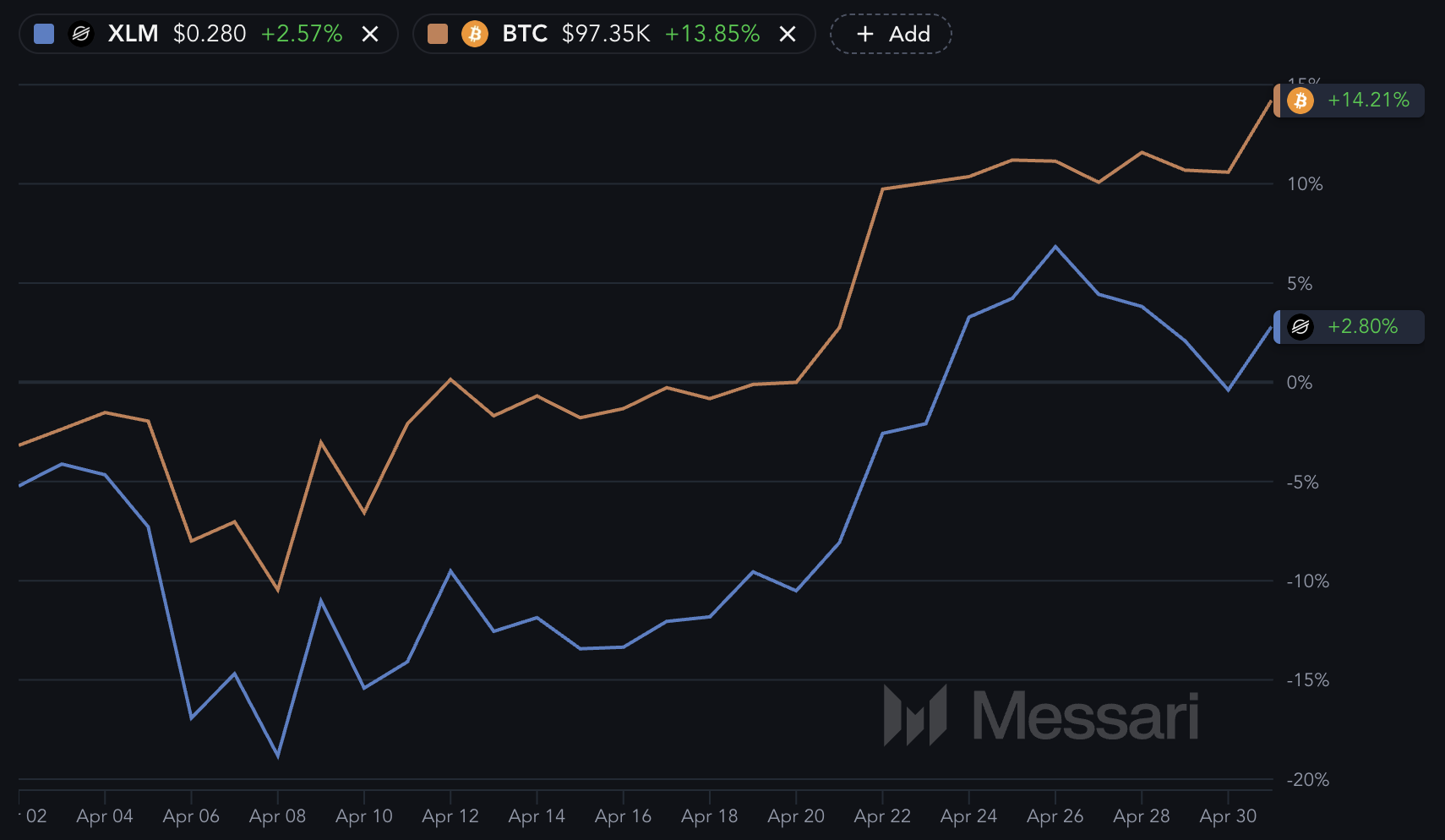

Entering May 2025, Stellar stands on shaky ground, trailing behind Bitcoin and other altcoins in both price movement and trading activity. While Bitcoin enjoys a notable surge, XLM has not only lagged but has also mirrored market corrections to a greater degree.

With a plummet in trading volume from earlier highs, it casts a formidable shadow over XLM’s potential for recovery. The cryptocurrency teeters above a significant support level, while ominous indicators of a potential death cross loom on the horizon.

XLM and BTC. Source: Messari.

Unlike the expected behavior of altcoins during market upswings, XLM is showcasing a concerning pattern: substantial declines without the anticipated gains. This asymmetry puts Stellar in a precarious position and casts doubt on its reliability in bullish market conditions.

Declining Volume Intensifies Concerns

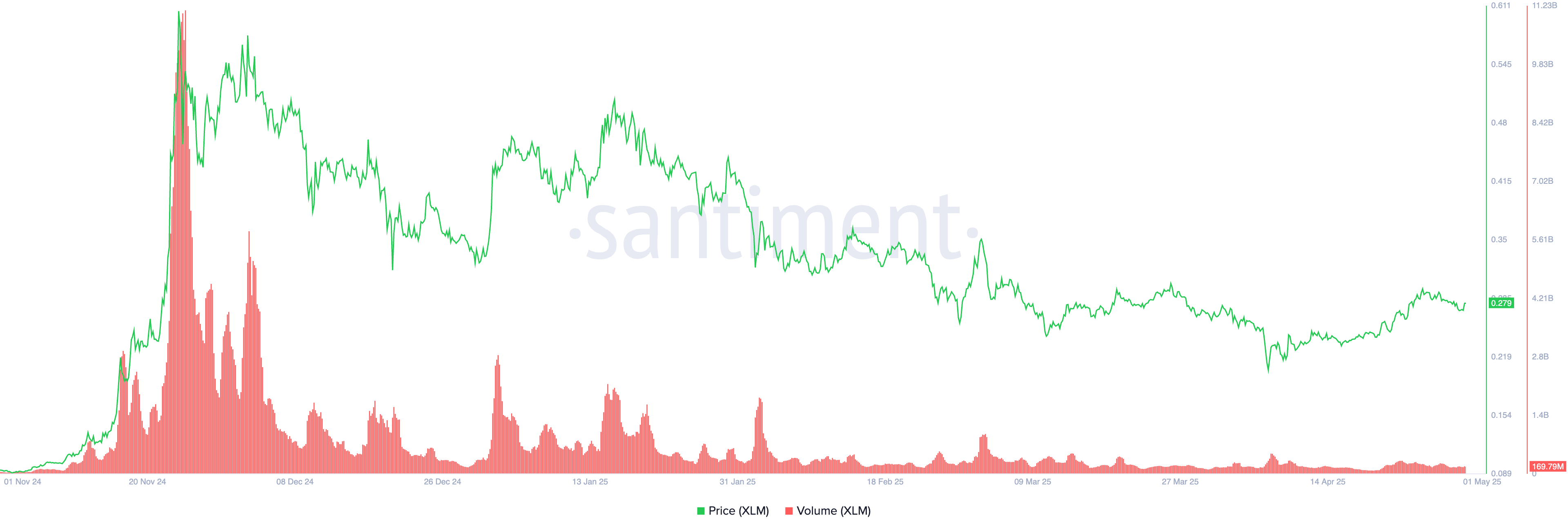

In the last month, Stellar’s trading volume has experienced a sharp drop, peaking at just $311 million on April 23, a stark contrast to earlier figures that exceeded $1 billion in January and February.

The downtrend signals not only a lack of interest but also threatens to limit any upward momentum for XLM, which is already struggling to keep pace with the broader market trends.

XLM Price and Volume. Source: Santiment.

Lackluster trading volume often correlates with weaker price performance. With current figures tightening, the chances for price rallies grow slimmer. As market interest wanes, Stellar finds itself facing an uphill battle for retention of its trading base and potential future investors.

Critical Support Levels Under Threat

At present, Stellar’s price hovers precariously above the crucial $0.26 support level. This juncture is pivotal in determining XLM’s trajectory for the coming weeks. Tightening EMA lines suggest that a death cross may be on the way, raising alarms about the possibility of significant downward movement.

XLM Price Analysis. Source: TradingView.

If the $0.26 support is breached, XLM faces heightened risk of further decline to $0.239 and potentially down to $0.20, signaling a profound bearish shift. On the flip side, if XLM manages to establish a robust bullish trend by breaking through the $0.297 resistance, it could open doors for recovery up to $0.349 and $0.375.

Conclusion

In conclusion, Stellar’s combination of weak performance, declining trading volume, and critical support levels highlight its vulnerability in the current market landscape. With looming indicators of a bearish shift, the outlook remains cautious unless we see a substantial change in market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin and Ethereum ETFs Record Substantial Outflows

Is 2025 the Right Time to Invest in Cryptocurrency?

Top 3 Crypto Presales You Shouldn’t Miss in 2025: BlockDAG, Cold Wallet, & Dragoin Gaining Momentum