Strategy Adds $555M Bitcoin—Stash Hits 538K BTC as Debt Looms

Strategy, led by executive chairman Michael Saylor, has once again strengthened its commitment to Bitcoin with a new acquisition totaling $555.8 million.

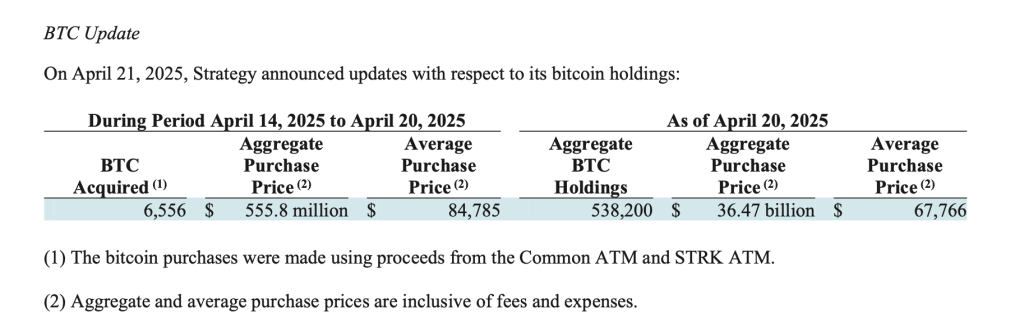

According to a regulatory filing released on Monday, the company purchased 6,556 BTC at an average price of $84,785 per coin. This latest acquisition reinforces Strategy’s position as the largest corporate holder of Bitcoin, a role it has embraced since initiating its accumulation strategy in 2020.

The funding for the purchase came from proceeds raised through the company’s two active at-the-market (ATM) equity offering programs. These programs allow Strategy to sell newly issued shares on the open market, using the capital to invest in Bitcoin.

This approach has been a hallmark of Saylor’s long-term vision: to convert the company’s balance sheet into a Bitcoin-backed treasury model.

As of April 20, 2025, Strategy now holds approximately 538,200 BTC. The total cost basis for these holdings stands at approximately $36.47 billion, with an average purchase price of $67,766 per bitcoin.

Despite the volatile nature of cryptocurrency markets, the company’s BTC yield for the year-to-date has reached an impressive 12.1%, showing both timing and market momentum.

Saylor’s unwavering belief in Bitcoin as a superior store of value continues to drive this aggressive acquisition strategy.

By using capital markets and maintaining a buy-and-hold approach, Strategy has positioned itself not only as a software company but also as a prominent institutional force in the digital asset space.

This most recent purchase displays continued confidence in Bitcoin’s long-term value and shows how traditional corporations can use financial tools to gain exposure to digital assets.

Strategy May Need to Sell BTC at a Loss to Cover Debt

According to a recent regulatory filing , Strategy revealed it may be forced to sell some of its Bitcoin holdings to meet financial obligations, potentially below cost basis.

Earlier this month, Strategy’s debt burden stood at $8 billion, with $35 million in annual interest and $150 million in yearly dividends further tightening the noose.

The firm’s software operations no longer generate enough revenue to sustain these obligations, and the long-touted promise of Bitcoin’s perpetual appreciation is being put to a brutal test.

Strategy’s Bitcoin playbook was initially praised for entering Bitcoin early, ahead of the 2021 bull run; the company expanded its holdings through a mix of convertible debt and equity offerings.

On April 7, Strategy also halted its Bitcoin purchases during a period of global financial instability, according to a filing submitted to the U.S. Securities and Exchange Commission.

The pause marked a shift in the firm’s usual aggressive Bitcoin acquisition strategy and came as digital asset markets reacted to fresh geopolitical risks. A legal filing dated April 7 revealed that Strategy did not purchase any Bitcoin between March 31 and April 6.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Whales Scoop Up 100M DOGE in a Week, Fueling $0.20 Breakout Hopes

‘Perfect Ponzi’: Dan Nathan Warns Trump Crypto Could Collapse Under Scrutiny

Bitcoin and Ethereum ETFs Record Substantial Outflows