Ethena Labs Leaves EU Market Over MiCA Compliance Issues

Ethena Labs is shutting down its German operations after a rejected MiCA application in March, transitioning users smoothly to its BVI platform. Despite a drop in its ENA token price, the company is focusing on new markets and partnerships for growth.

Ethena Labs is officially closing its German branch and EU operations after a previous MiCA application rejection. For the past month, the firm has been preparing to withdraw from this market.

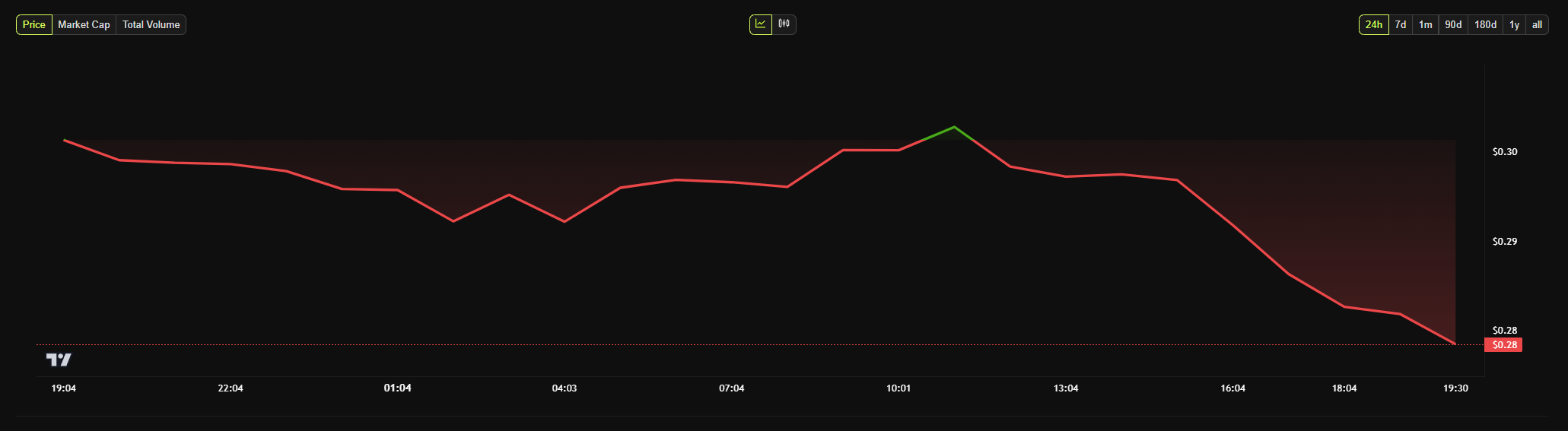

Although the exit was anticipated, ENA reacted notably, with the altcoin falling over 7% after today’s announcement.

Ethena Labs Failed MiCA Effort

Ethena Labs has been facing continued regulatory difficulties in Europe. In late March, German authorities rejected Ethena’s application for MiCA compliance.

At the time, the firm suggested that this was a minor setback and that it would focus on other markets. Today, it announced that its German branch is winding down altogether.

“We have agreed with BaFin to wind down all activities of Ethena GmbH and will no longer be pursuing the MiCAR authorization in Germany. All whitelisted… users previously interacting with Ethena GmbH have at their request been onboarded with Ethena (BVI) Limited instead. As a result, Ethena GmbH no longer has any direct customers,” it claimed.

The statement further claimed that Ethena GmbH, the German branch, “has not conducted any mint or redeem activity” since the regulators’ MiCA ruling.

Specifically, regulators banned all sales of the USDe stablecoin, putting serious restrictions on the firm. In other words, this outcome is fairly expected. Ethena (BVI) Limited has taken over the German branch’s users.

The network’s governance token, ENA, has seen notable price swings around its MiCA efforts. In Early March, when Ethena Labs was reportedly on track to receive regulatory approval, ENA broke out of multi-month lows and nearly reached $2.5 billion in mark cap.

However, since the rejection, ENA saw continued bearish pressure, which was exacerbated by the macroeconomic conditions across the market. Today’s announcement drove further decline.

Ethena Daily Price Chart. Source:

BeInCrypto

Ethena Daily Price Chart. Source:

BeInCrypto

MiCA, the European Union’s new stablecoin regulations, have presented difficulties for several firms besides Ethena. For example, Tether’s stablecoins were delisted from EU exchanges when MiCA took effect, prompting serious changes to its business.

Several other issuers have been racing to fill the gap left by these firms by achieving compliance. Most recently, major centralized exchanges such as Crypto.com and OKX have achieved the license, further strengthening their grasp over the EU market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Qubetics Presale Hits $16.5M – Top Crypto to Buy Now as Arbitrum and Immutable X Make Waves

Explore Qubetics, Arbitrum, and Immutable X, the top crypto to buy in 2025. Dive into their unique features, presale updates, and blockchain impact.Qubetics: Leading the Charge in Blockchain InteroperabilityArbitrum Enhances Blockchain Privacy with New Web AppImmutable X Partners with Ubisoft to Launch New Blockchain GameInteroperability in Blockchain: The Future is ConnectedConclusionFor More Information:

Open Project proposes tokenized securities on Solana blockchain with support from Superstate and Orca

UK Government Releases Comprehensive Draft Legislation to Support Industry and Curb Fraud

The UK government has unveiled a 27-page draft legislation aimed at bringing cryptocurrency activities under formal financial regulation for the first time. This move seeks to foster innovation while protecting consumers by extending existing financial rules to digital assets like stablecoins, crypto exchanges, and custodial services.

Bitcoin, Ethereum ETFs Witness Significant US Inflows