Cryptocurrency Market Signals Buying Opportunities for Altcoin Traders

In Brief The cryptocurrency market's decline has created new buying opportunities for traders. Technical signals may be less effective due to geopolitical uncertainties. A recovery in the crypto market depends on resolving global trade tensions.

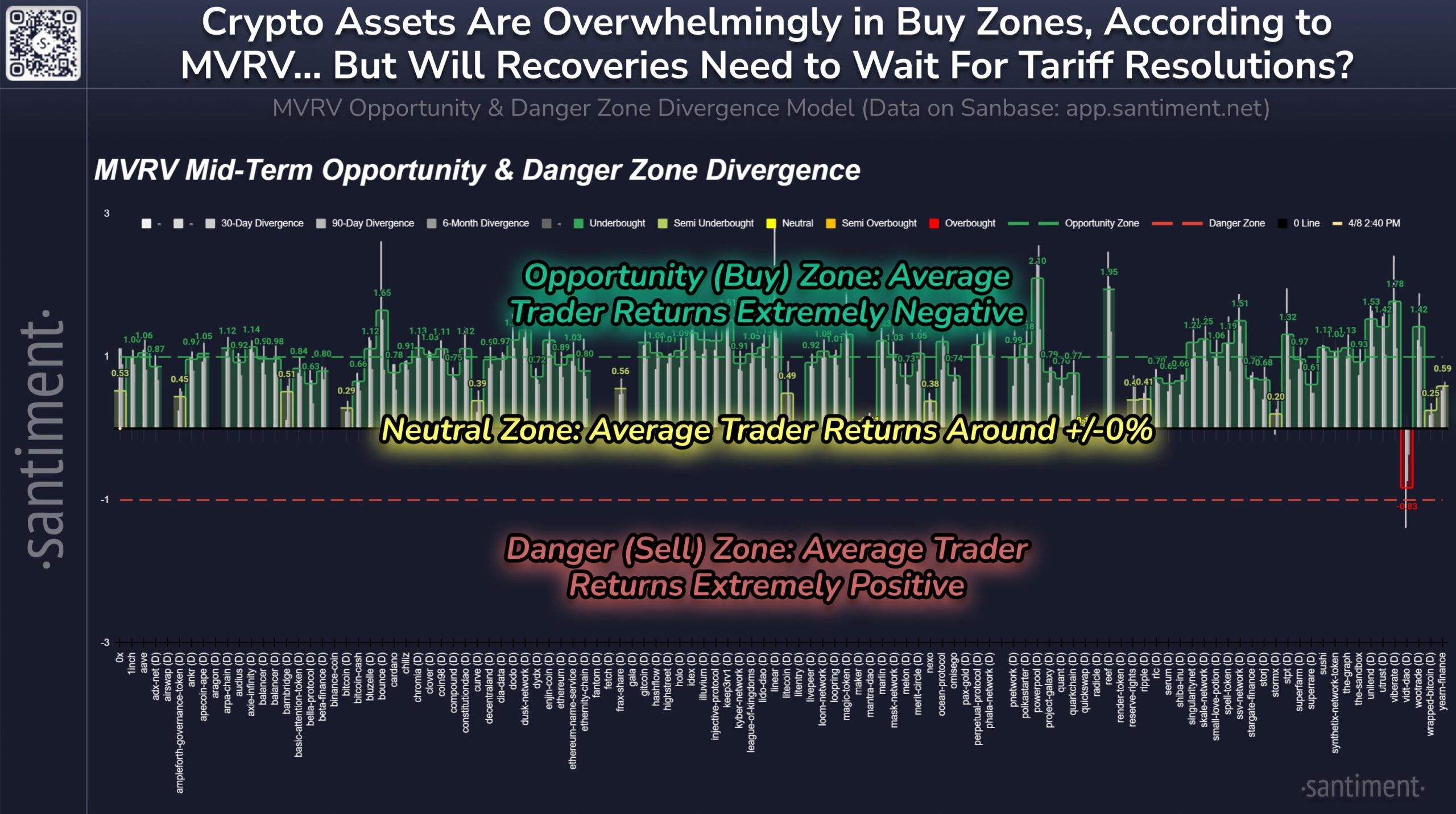

The cryptocurrency market has recently experienced a sharp decline, prompting traders to reassess potential “buying opportunities.” Santiment’s MVRV (Market Value/Realized Value) analysis model provides notable insights, particularly for altcoin traders. This model reveals that many altcoins are currently in the “buying zone.” However, due to global trade tensions and geopolitical uncertainties, it’s unclear when these signals will translate into tangible benefits.

Prices Enter Buying Zones, But…

According to Santiment’s latest analysis, the MVRV indicator has shown significant negative returns for most altcoins in medium-term timeframes. This scenario indicates that a considerable portion of traders is operating at a loss, typically suggesting a favorable environment for bottom-buying. Nevertheless, experts caution that such technical signals can sometimes become ineffective in the face of global macro developments.

The Santiment report highlights that many altcoins are currently positioned within the “Opportunity Zone,” which corresponds to levels where past trading performance has been quite negative. This indicates that most traders are currently at a loss, providing a potential advantage for new buyers. While the neutral zone of the MVRV shows returns around ±0%, the current averages are significantly below this level.

A significant number of altcoins, including 1inch, Aave, Ampleforth, and others, are now categorized within this opportunity zone.

Santiment Altcoin List

Santiment Altcoin List

However, it is evident that markets do not solely rely on technical signals for direction. The escalating trade wars, particularly between the U.S. and China, contribute to increased uncertainty within the cryptocurrency market. Similar to the early stages of COVID-19, conventional analysis models may lose relevance during such extraordinary times. Therefore, it is crucial for traders to monitor global developments alongside technical analysis.

Potential Rapid Recovery if Trade Wars End

One of the critical factors affecting the cryptocurrency market is the ongoing global tariff crisis. The new trade policies implemented by the U.S. have strained economic relations with several countries. This instability in global trade is undermining confidence in the cryptocurrency market as well, pushing investors to avoid risk and creating selling pressure.

Santiment suggests that resolving trade wars could trigger a swift and robust recovery in cryptocurrencies. Yet, this possibility appears very uncertain at present. The frequent media coverage of the “global trade war” has led investors to adopt a wait-and-see approach. Consequently, while buying signals may be increasing in altcoins, a significant recovery requires the elimination of geopolitical hurdles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether’s U.S. Treasury holding approaches record high of $120B

Share link:In this post: Today, Tether published its Q1 2025 attestation report prepared by BDO, confirming total exposure in U.S. Treasuries approaching $120B. Tether also reported over $1B in operating profit from traditional investments during the quarter, driven by solid performance in its U.S. Treasury portfolio. The milestones reinforced the company’s conservative reserve management strategy and highlighted its growing role in distributing dollar-backed liquidity at scale.

Automakers like Ford in solid April sales driven by panic buying amid tariff worries

Share link:In this post: Consumers rushed to buy vehicles on fears of potential price hikes due to the Trump tariffs. While there was strong demand which started in March, this started to wane towards the end of April. For Ford, it reported a 16% sales increase in April.

Arbitrum offers as much as $100k per report to snitch on wasteful DAOs

Share link:In this post: Arbitrum is offering up to $100,000 in ARB tokens to community members who report DAO grant misuse. The “Watchdog” program encourages confidential whistleblowing via the open-source platform, GlobaLeaks. Severity of violations determines the reward, with a funding cap of 400,000 ARB.

Meta, Microsoft earnings beat send stocks higher

Big Tech pulled US indexes back into the green Thursday, as investors waited for two more Mag 7 first-quarter reports after the bell