BREAKING: Top U.S. Bank to Allow Consultants to Promote Bitcoin ETF

A few days ago, Bloomberg reported that Morgan Stanley will enable thousands of its financial advisors to start recommending spot Bitcoin exchange-traded funds (ETFs) to clients in the near future.

The firm has reportedly informed its 15,000 advisors that they can begin offering clients the option to invest in BlackRock Inc.’s iShares Bitcoin Trust (IBIT) or the Fidelity Wise Origin Bitcoin Fund (FBTC). Despite multiple reports, including one by CNBC, Morgan Stanley chose not to comment on the development at the time.

According to new information from multiple sources on X (Twitter), including Poloniex and Cointelegraph , the bank’s financial advisors are officially allowed to offer clients trading in Bitcoin ETFs as of today, a historic first for a major bank.

The new policy restricts offers to clients who meet certain criteria: they must have a net worth of at least $1.5 million, possess a high-risk tolerance, and be interested in speculative investments.

Morgan Stanley’s move may influence other banks that are cautious about entering the digital asset space to reconsider their stance. After the U.S. Securities and Exchange Commission approved several spot Bitcoin ETFs in January, those funds have significantly exceeded expectations in terms of assets and flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Janover Initiates Solana-Focused Treasury Strategy Post Rebrand

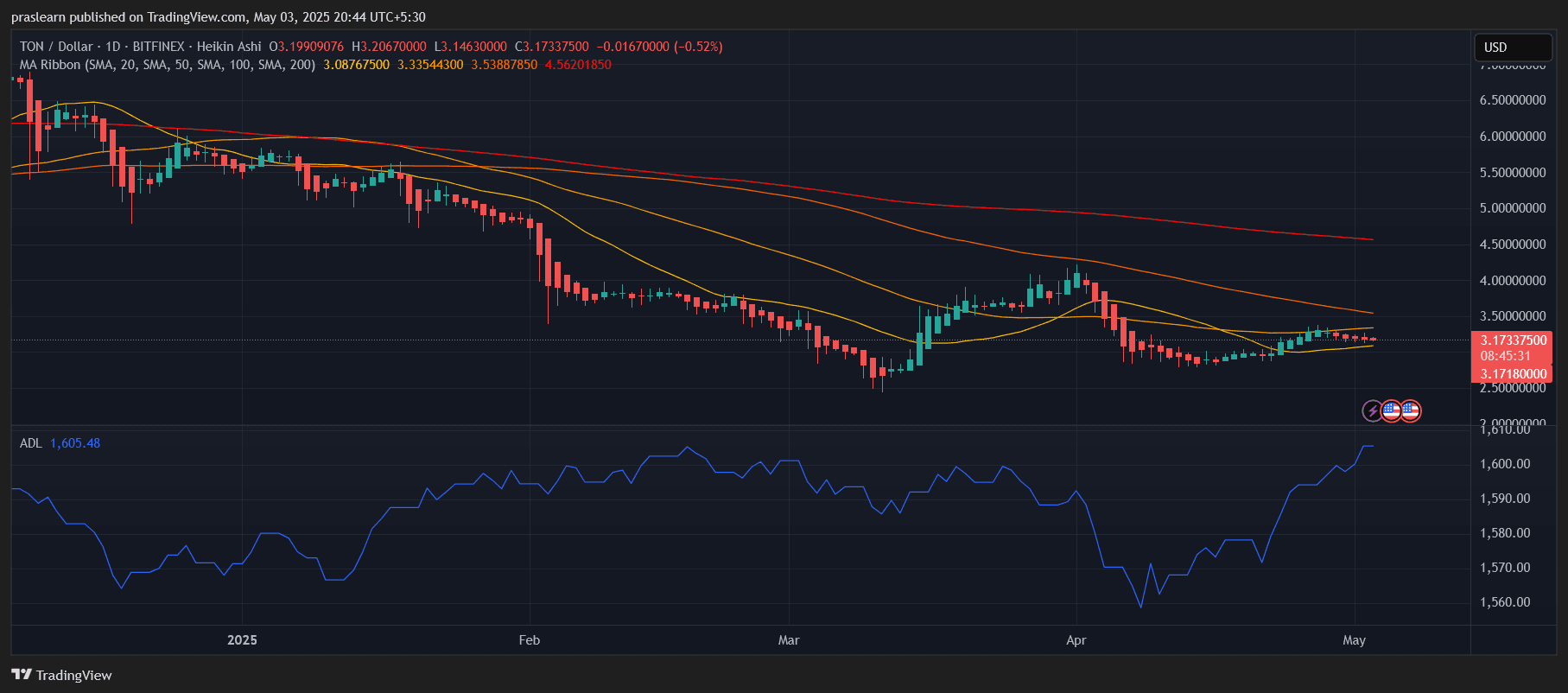

TON Price Prediction: Can Toncoin Hit $4 in May?

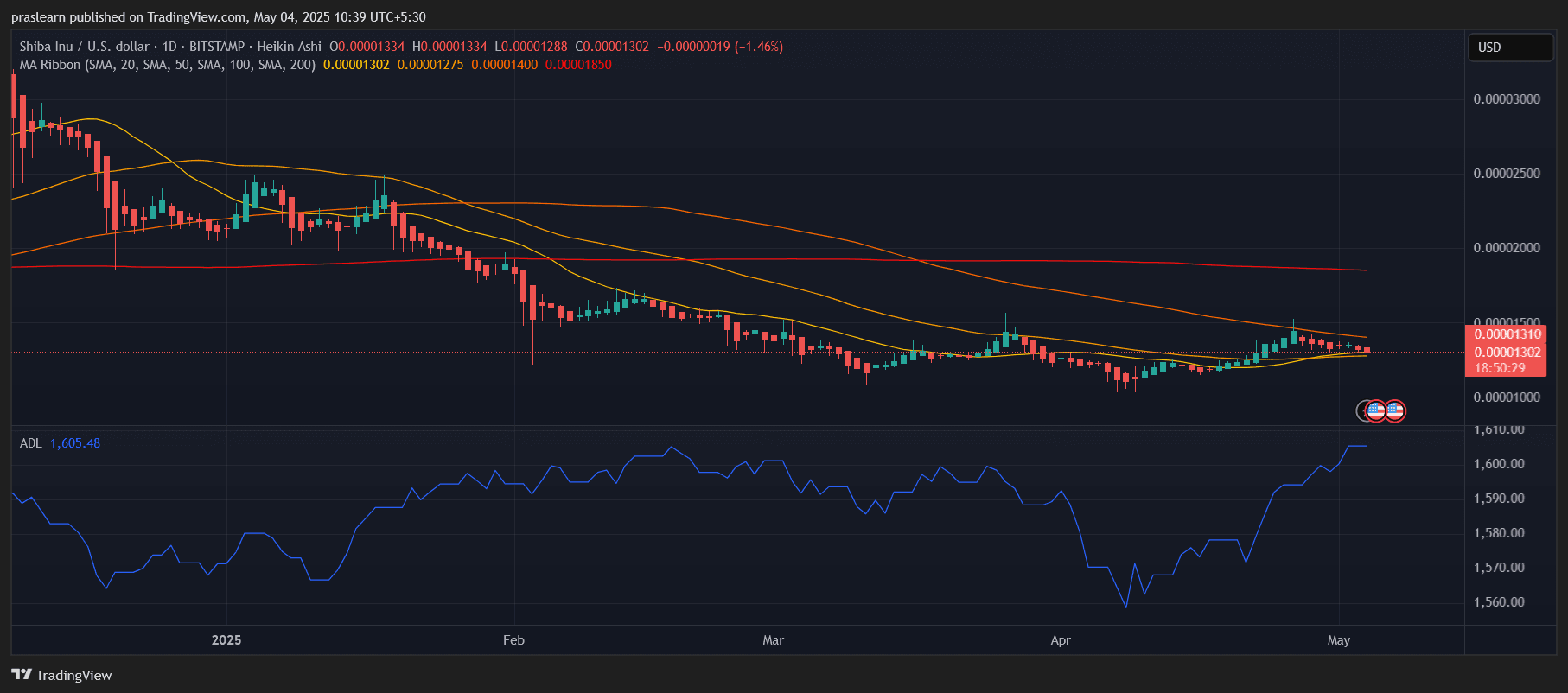

Will Shiba Inu Price Reach $1 in May?

New Litecoin Price Prediction Targets $100 and Beyond – Where Is LTC Headed Next?