Ethereum ETF flows turn positive as BlackRock fund logs $118 million inflows

Key Takeaways

- BlackRock's iShares Ethereum Trust led with $118 million in inflows, courting major outflows from Grayscale's fund.

- US spot Ethereum ETFs collectively posted nearly $34 million in net inflows on July 30.

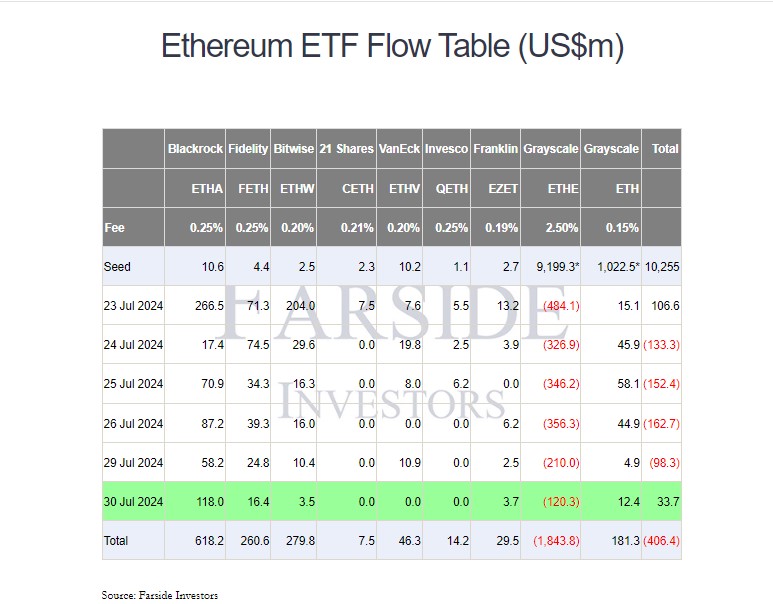

Net flows into the group of nine spot Ethereum exchange-traded funds (ETFs) turned positive in Tuesday trading as BlackRock’s iShares Ethereum Trust (ETHA) raked in $118 million in net inflows, sufficiently offsetting large withdrawals from Grayscale’s Ethereum ETF (ETHE), according to data from Farside Investors.

Investors pulled around $120 million from Grayscale’s ETHE on Tuesday, bringing the outflows after six trading days to over $1.8 billion. Since the fund’s conversion, its assets under management have dropped from over $9 billion to $6.8 billion, according to updated data from Grayscale.

US spot

Ethereum ETF Flows on July 30 – Source: Farside Investors

US spot

Ethereum ETF Flows on July 30 – Source: Farside Investors

Fidelity’s Ethereum fund (FETH) and Grayscale’s Ethereum Mini Trust (ETH) ended the day with over $16 million and $12 million in net inflows, respectively. Other gains were also seen in Bitwise’s Ethereum ETF (ETHW) and Franklin Templeton’s Ethereum ETF (EZET).

The combined net inflows successfully offset Grayscale’s strong outflows, turning ETF flows positive on July 30. Overall, US spot Ethereum posted almost $34 million in inflows.

While ETF flows reversed course on Tuesday, the current downward pressure on Ethereum (ETH) due to heavy outflows from Grayscale’s ETHE is unlikely to fade away.

However, analyst Mads Eberhardts anticipates the outflow slowdown will happen by the end of the week. Once outflows stabilize, a potential price increase could follow, Eberhardts suggests.

Ethereum is currently trading at around $3,200, down 4% over the past week, CoinGecko’s data shows. The price peaked at $3,500 at the Ethereum ETF debut but dropped 10% in the following days.

The situation is relatively similar to Bitcoin’s price actions following the launch of spot Bitcoin ETFs in January. Pseudonymous trader Evanss6 noted that Bitcoin’s price recovered once outflows from Grayscale’s Bitcoin ETF (GBTC) subsided.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether’s U.S. Treasury holding approaches record high of $120B

Share link:In this post: Today, Tether published its Q1 2025 attestation report prepared by BDO, confirming total exposure in U.S. Treasuries approaching $120B. Tether also reported over $1B in operating profit from traditional investments during the quarter, driven by solid performance in its U.S. Treasury portfolio. The milestones reinforced the company’s conservative reserve management strategy and highlighted its growing role in distributing dollar-backed liquidity at scale.

Automakers like Ford in solid April sales driven by panic buying amid tariff worries

Share link:In this post: Consumers rushed to buy vehicles on fears of potential price hikes due to the Trump tariffs. While there was strong demand which started in March, this started to wane towards the end of April. For Ford, it reported a 16% sales increase in April.

Arbitrum offers as much as $100k per report to snitch on wasteful DAOs

Share link:In this post: Arbitrum is offering up to $100,000 in ARB tokens to community members who report DAO grant misuse. The “Watchdog” program encourages confidential whistleblowing via the open-source platform, GlobaLeaks. Severity of violations determines the reward, with a funding cap of 400,000 ARB.

Meta, Microsoft earnings beat send stocks higher

Big Tech pulled US indexes back into the green Thursday, as investors waited for two more Mag 7 first-quarter reports after the bell