QCP Capital forecasts significantly greater volatility for Ethereum compared to bitcoin

Ethereum is poised for larger price swings than bitcoin, with its volatility premium widening to 8%, analysts said.Analysts favor Ethereum accumulation due to its cost-effective spot price and robust performance amid wider crypto market fluctuations.

Ethereum ETH +0.010% is anticipated to experience significantly larger price swings than bitcoin in the future, as reflected in the higher options volatility premium for the second-largest asset by market capitalization.

"The volatility premium of Ethereum to bitcoin has widened to about 8% for the longer tenor expiries, up from 4% last week," QCP Capital analysts said.

QCP Capital analysts also expressed a preference for accumulating Ethereum , noting its cost-effective spot price when considering the rise in the asset's implied volatility.

Ethereum remains more robust than bitcoin

The analysts observed that Ethereum has maintained its price more effectively than bitcoin, despite the market caution that followed the U.S. government's transfer of 30,000 BTC , valued at approximately $2 billion, to an unidentified wallet, according to Arkham Intelligence data.

"Ethereum spot has performed relatively well compared to bitcoin following Trump's speech, with the ETH-BTC trade gaining 5% since, despite its fourth consecutive day of spot exchange-traded (ETF) outflows," QCP Capital analysts said.

Spot Ethereum ETFs experienced negative net flows in their first week , marked by $1.5 billion in net outflows from Grayscale’s ETHE. In contrast, just over $1 billion in net inflows were recorded into eight competing funds, including BlackRock's ETHA and Bitwise’s ETHW.

However, QCP Capital analysts noted that if outflows from Grayscale's ETHE become exhausted and daily inflows into Ethereum ETFs increase, the second-largest digital asset could experience a significant upward breakout.

Ethereum has traded flat over the past 24 hours, now changing hands for $3,354 as of the time of writing, according to The Block's Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

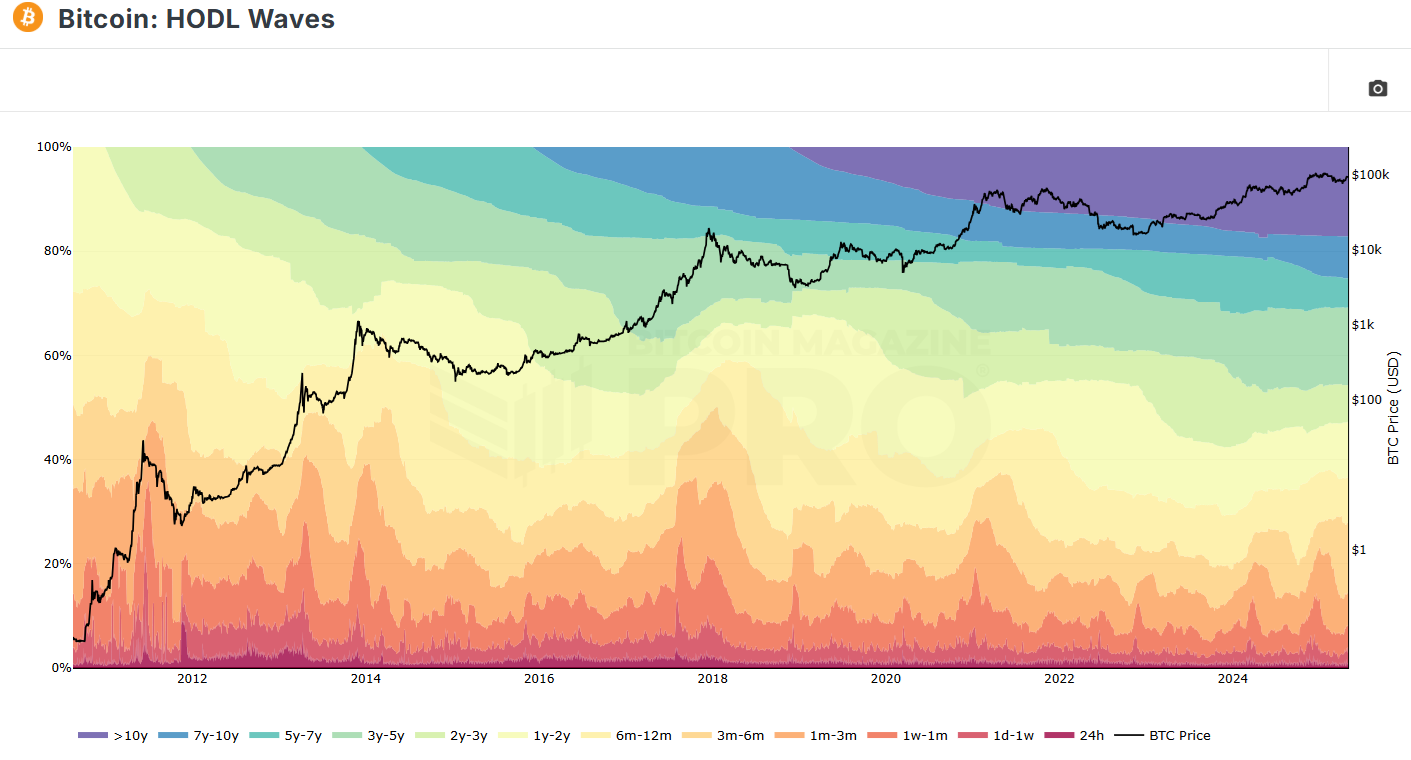

Long-term BTC holders are back in accumulation mode

Share link:In this post: The period of capitulation and spot selling has ended, and almost all wallet cohorts either hold or accumulate. 87.6% of the BTC supply is in profit, as the coin consolidates around $97,000. Short term buyers are in the money, feeling less pressure for wallets aged less than one month.

US stocks surge as jobs data eases recession fears, S&P 500 eyes 20-year win streak

Share link:In this post: The S&P 500 jumped 1.5% on Friday, heading for its longest winning streak since 2004. April payrolls beat expectations with 177,000 jobs added, easing recession fears. Apple dropped 3% after missing revenue targets, while Amazon rose slightly.

Three Key Scenarios for Bitcoin Price in 2025 – Could BTC Hit $175,000?

Hedera (HBAR) Struggles to Build Bullish Pattern in Tight Range