USDC vs USDT: Differences Explained

Stablecoins have emerged as an integral part of the cryptocurrency market. Notably, stablecoins like USDT and USDC are garnering increasing attention from investors due to their stable value and effective risk management. But what are the differences between USDC vs USDT? This article will dive into the uses, risks, and interest-related aspects of stablecoins.

USDC vs USDT: Which one is the best stablecoin?

Stablecoins are a type of cryptocurrency. Virtual currencies generated by algorithms or proof-of-stake mechanisms are prone to volatility and lack the ability to store value, making them unsuitable to replace centralized currencies and are often viewed as speculative assets. The core idea behind stablecoins is to create a decentralized ledger-based currency with a mechanism to maintain stable value. Some view stablecoins to be tokens backed by centralized assets, with their value directly tied to the value of these assets.

USDT (Tether) and USDC (USD Coin) are the most well-known stablecoins in the market. Both are pegged to the US dollar at a 1:1 ratio, meaning their value is equivalent to one US dollar. USDT was created by Tether Limited, while USDC is a joint effort by Coinbase and Circle. USDT and USDC are not only the most recognized stablecoins, but they are leading in market capitalization and trading volume on a daily and monthly basis. These exceptional stablecoins bridge the gap between crypto and fiat currencies, allowing investors to trade in US dollars without the volatility associated with regular cryptocurrencies. Additionally, crypto enthusiasts can use USDT or USDC to make fast and reliable transactions on blockchains.

USDC vs USDT: What are the main differences?

So, what sets USDC and USDT apart from each other?

While these stablecoins share many similarities, including their names, they also have significant differences that are crucial for the cryptocurrency market.

Firstly, the issue of transparency and credibility.

USDT is produced and fully controlled by Tether Limited, meaning there is no third-party or centralized authority to influence its management. In contrast, USDC has been subject to continuous regulation and oversight by US authorities and banks since its inception. This oversight has bolstered traditional investors' and institutions' confidence and demand for USDC.

Secondly, in terms of maintaining price stability, they differ noticeably despite both being stablecoins. USDT uses a reserve system, where each token is backed by financial reserves in US dollars or other assets controlled by the company. On the other hand, USDC uses a "capital control" system, where each token is backed by US dollar assets held in bank accounts. This makes the USDC system more transparent and allows for more precise reporting, which is why we often see asset reports or proofs for USDC.

Lastly, these stablecoins are issued on different blockchains. USDC is an ERC-20 token issued on the Ethereum blockchain, whereas USDT is issued on multiple blockchains, including Ethereum (ERC-20) and Tron.

Overall, USDC is considered more secure and reliable compared to USDT when it comes to credibility and transparency. The collateral for USDC is consistently disclosed, and the companies behind it, Circle and Coinbase, are highly reputable in the cryptocurrency industry. It's worth noting that USDT has faced several accusations in the past regarding its lack of transparency and stability.

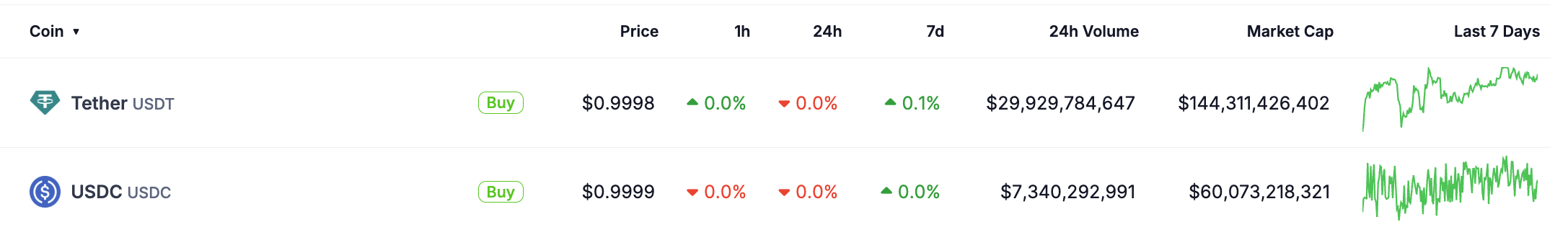

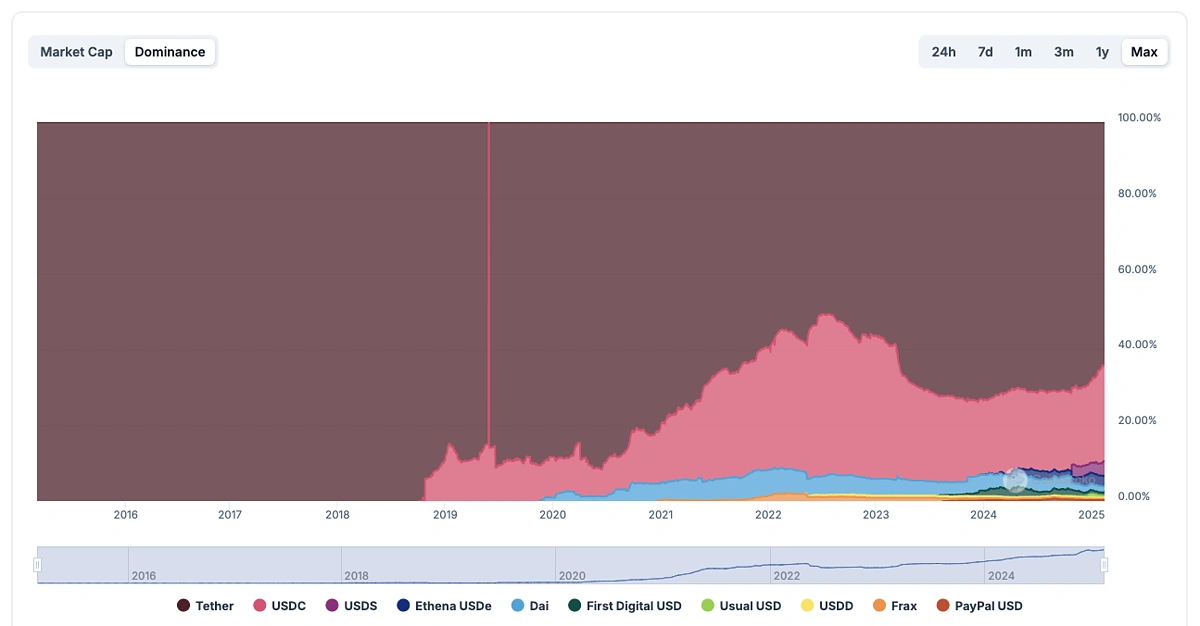

USDC vs USDT: Market cap and market dominant

Short answer: USDT is the one with a higher market cap.

USDT's market cap today is $144,311,426,402 while USDC's market cap is $60,073,218,321.

While USDT and USDC are the dominant stablecoins, other options like DAI (a decentralized, Ethereum-based stablecoin) and Ethena USDe are also emerging. The choice of stablecoin depends on the blockchain network you prefer and the platforms you wish to interact with.

USDC vs USDT: Which stablecoin is safer?

In terms of popularity and trading volume, USDT, being established earlier in 2014, is more widely used. However, when it comes to security, USDC stands out as a better choice. Security is paramount in any transaction, particularly in the cryptocurrency industry where protecting user assets from loss is always a top priority.

From a security and reliability perspective, USDT has encountered various issues due to the opacity of Tether's reserve structure. As mentioned earlier, USDT is entirely controlled by its parent company, Tether Limited, raising concerns about its transparency and security.

In contrast, USDC has a more transparent support system and clarity, making it more appealing to users in some cases. USDC publishes monthly audit reports to confirm the full coverage of its dollar reserves. Additionally, the collateral for USDC is consistently disclosed, and the companies behind it, Circle and Coinbase, are highly reputable in the cryptocurrency industry. It's worth noting that USDT has faced several accusations in the past regarding its lack of transparency and stability.

Therefore, USDC is considered more secure than USDT due to its well-coordinated operations and transparent support system.

Before using any cryptocurrency, it's crucial to explore and assess all potential risks. When choosing between Tether and USD Coin, do your own research and select the stablecoin that is most suitable and reliable for your needs.

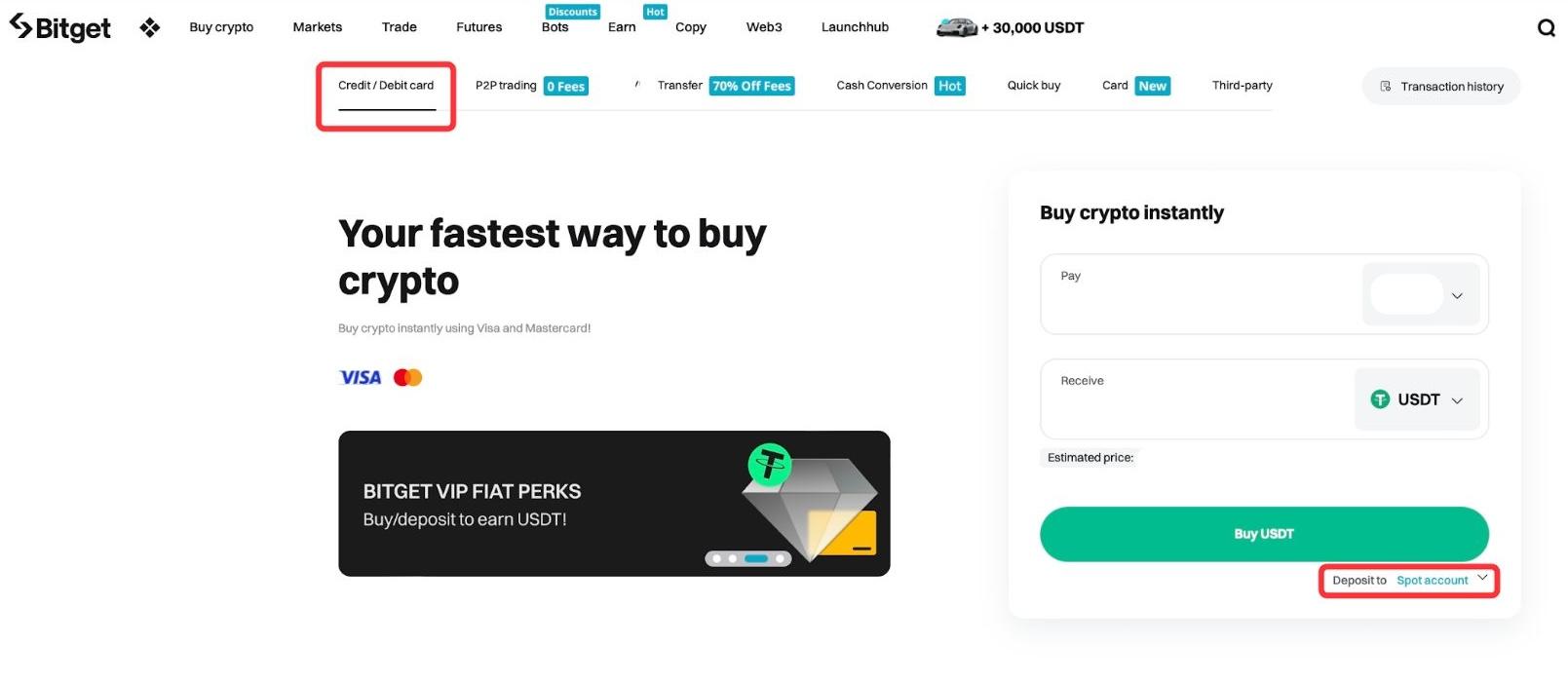

USDC vs USDT: Which one to buy and how to buy at the best price on Bitget?

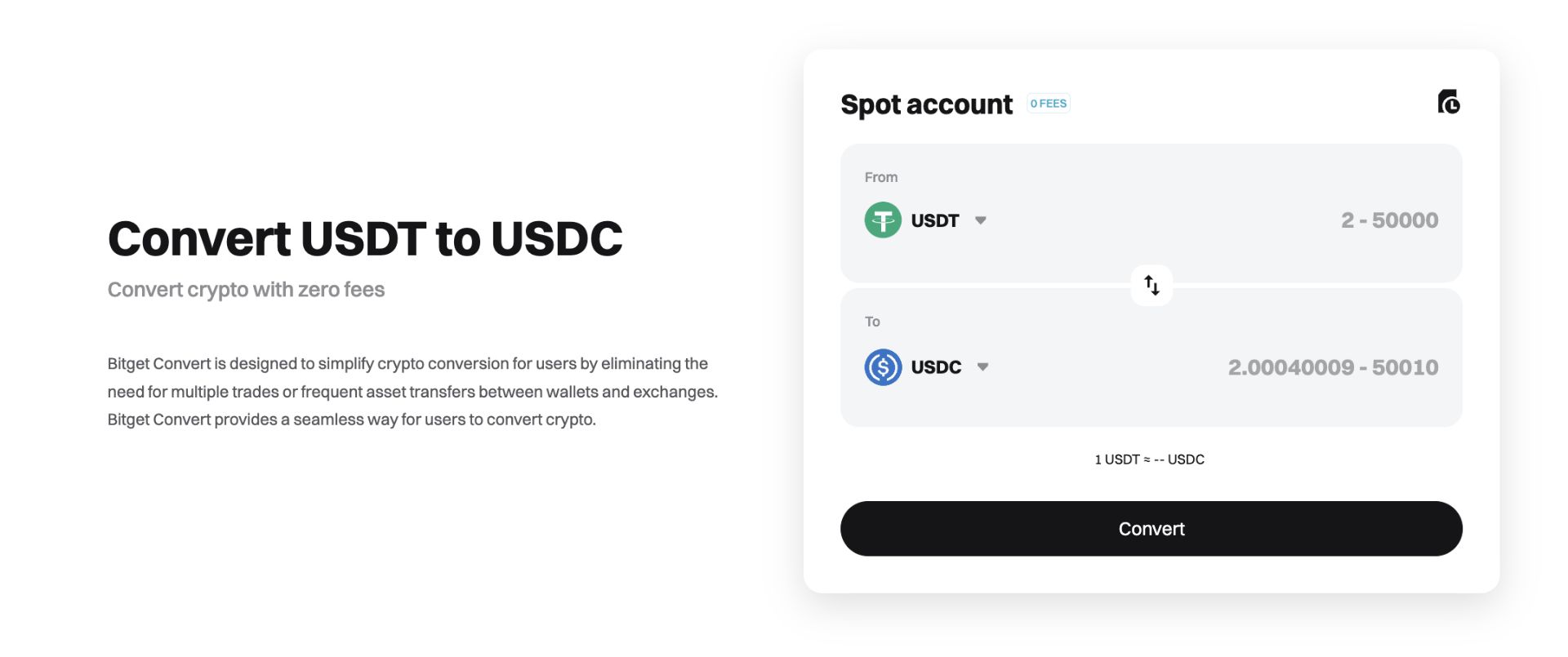

For users accustomed to using USDT, having another option like USDC is a prudent choice. Bitget offers a easy method for USDC/USDT conversions.

If you are a new user, simply sign up on Bitget, complete the identity verification process, then you can buy and sell USDC and USDT easily on Bitget via credit/debit cards, e-wallets, p2p market, or other local payment options. Here’s how:

How to buy USDC and USDT on Bitget:

-

Create an account on Bitget, or log in to your existing one.

-

Go to the Buy Crypto section.

-

Choose your preferred payment method and complete your purchase.

USDT vs. USDC: Convert and swap

- Top 7 Trump Coins to Watch in 20252025-04-25 | 5m